You might need to raise the transaction limit on your account as your financial needs develop. This could be for emergencies, expanding businesses, or increased costs.

Here, we offer sample applications for various scenarios to make it simple for you to ask your bank for an increase in your transaction limit.

1. Application for Increasing Threshold Due to Salary Increment

To,

The Branch Manager,

[Bank Name],

[Branch Name],

[City, State, Pin Code]

Date: [Insert Date]

Subject: Request to Increase Transaction Threshold Limit

Respected Sir/Madam,

I, [Your Name], hold a savings account with your bank (Account Number: [Your Account Number]). Due to a recent salary increment, my monthly transactions have significantly increased, and the current transaction threshold limit is insufficient.

I kindly request you to increase my transaction limit to [Desired Limit]. I have attached my salary slip as proof of my updated income.

Thank you for your assistance.

Yours sincerely,

[Your Name]

[Your Contact Number]

2. Application for Higher Limit for Business Transactions

To,

The Branch Manager,

[Bank Name],

[Branch Name],

[City, State, Pin Code]

Date: [Insert Date]

Subject: Request to Increase Transaction Limit for Business Account

Respected Sir/Madam,

I am [Your Name], the proprietor of [Business Name] and hold a business account with your bank (Account Number: [Your Account Number]). Due to the growth of my business, I am conducting higher-value transactions frequently.

I request an increase in my account's transaction limit to [Desired Limit] to accommodate these needs. I have attached my recent account statement and business invoices for your reference.

Thank you for your prompt attention to this matter.

Yours sincerely,

[Your Name]

[Your Contact Number]

3. Application for Increasing Limit for Emergency Transactions

To,

The Branch Manager,

[Bank Name],

[Branch Name],

[City, State, Pin Code]

Date: [Insert Date]

Subject: Request for Increased Transaction Threshold for Emergencies

Respected Sir/Madam,

I, [Your Name], hold a savings account with your bank (Account Number: [Your Account Number]). I frequently encounter emergencies requiring higher-value transactions, but the current threshold is restrictive.

I kindly request an increase in the transaction limit to [Desired Limit] to address such situations efficiently. Supporting documents, including my account statement, are attached for your review.

Yours sincerely,

[Your Name]

[Your Contact Number]

4. Application for Raising Limit for Investment Purposes

To,

The Branch Manager,

[Bank Name],

[Branch Name],

[City, State, Pin Code]

Date: [Insert Date]

Subject: Request to Increase Transaction Limit for Investment Transactions

Respected Sir/Madam,

I, [Your Name], am a customer with an account in your bank (Account Number: [Your Account Number]). As I have recently started investing in high-value financial instruments, I need a higher transaction threshold to execute these investments seamlessly.

Kindly increase my transaction limit to [Desired Limit]. I have attached my account statement and recent investment receipts for your consideration.

Yours sincerely,

[Your Name]

[Your Contact Number]

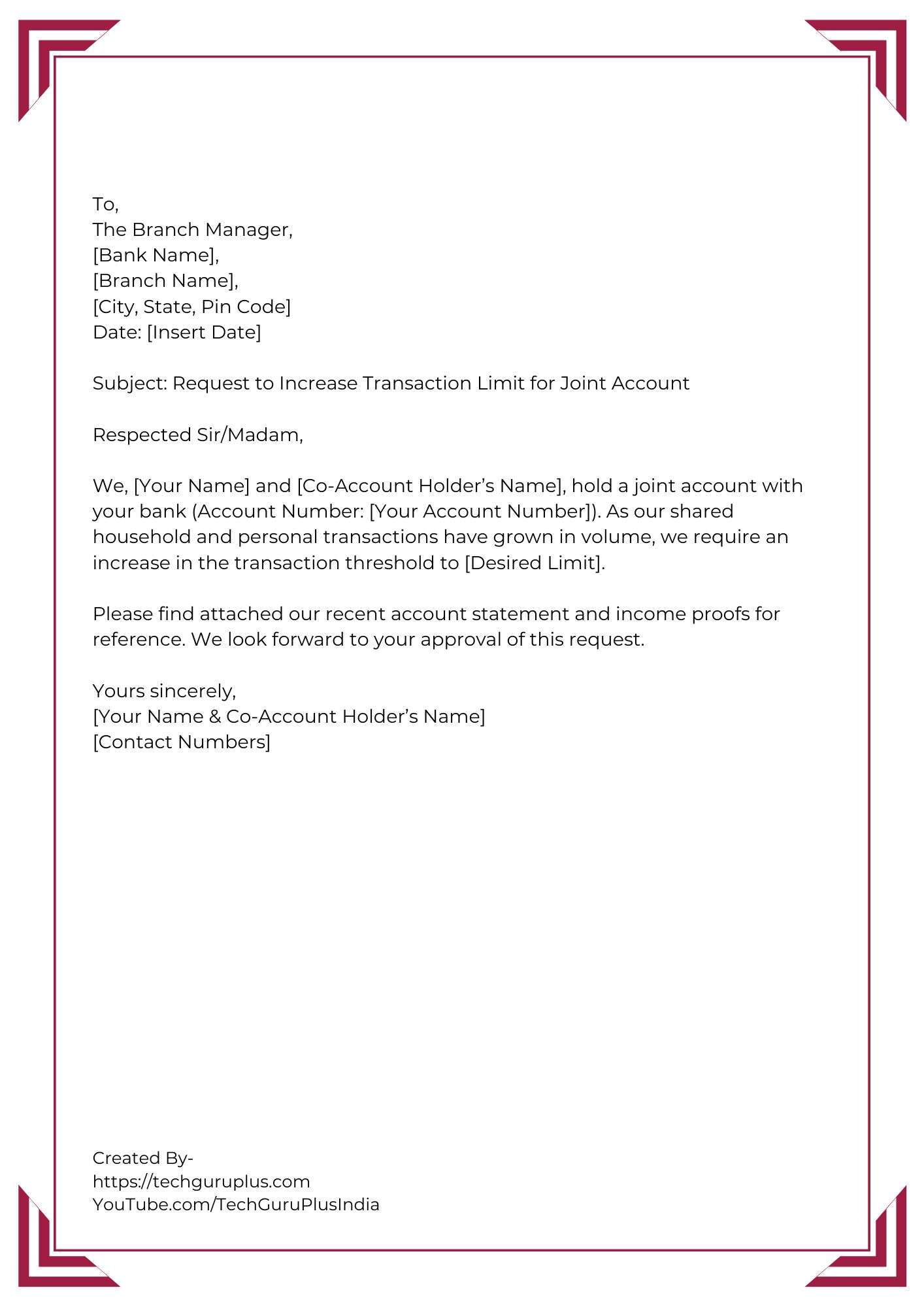

5. Application for Joint Account Limit Increase Due to Shared Transactions

To,

The Branch Manager,

[Bank Name],

[Branch Name],

[City, State, Pin Code]

Date: [Insert Date]

Subject: Request to Increase Transaction Limit for Joint Account

Respected Sir/Madam,

We, [Your Name] and [Co-Account Holder’s Name], hold a joint account with your bank (Account Number: [Your Account Number]). As our shared household and personal transactions have grown in volume, we require an increase in the transaction threshold to [Desired Limit].

Please find attached our recent account statement and income proofs for reference. We look forward to your approval of this request.

Yours sincerely,

[Your Name & Co-Account Holder’s Name]

[Contact Numbers]

Key Points to Consider

Understand the Current Limit: Know the existing transaction limit for your account type.

State Your Purpose Clearly: Explain why you need the increase, such as business needs, frequent transfers, or emergencies.

Attach Necessary Documents: Include identity proof, account statement, and supporting documents for the request (e.g., proof of increased income or business growth).

Visit the Bank: Submit your application in person for faster processing, if required.

Bank Policies: Be aware of any charges or conditions that may apply to increasing the limit.

You can effectively handle higher-value transactions, whether for emergency, business, or personal reasons, by raising your transaction threshold limit. For speedier processing, make sure your request is supported by correct information and pertinent documentation.

Since every circumstance calls for a different strategy, make use of the offered templates to efficiently create your application. You can easily meet your financial needs if you work closely with your bank and are aware of their policies.

Thank you