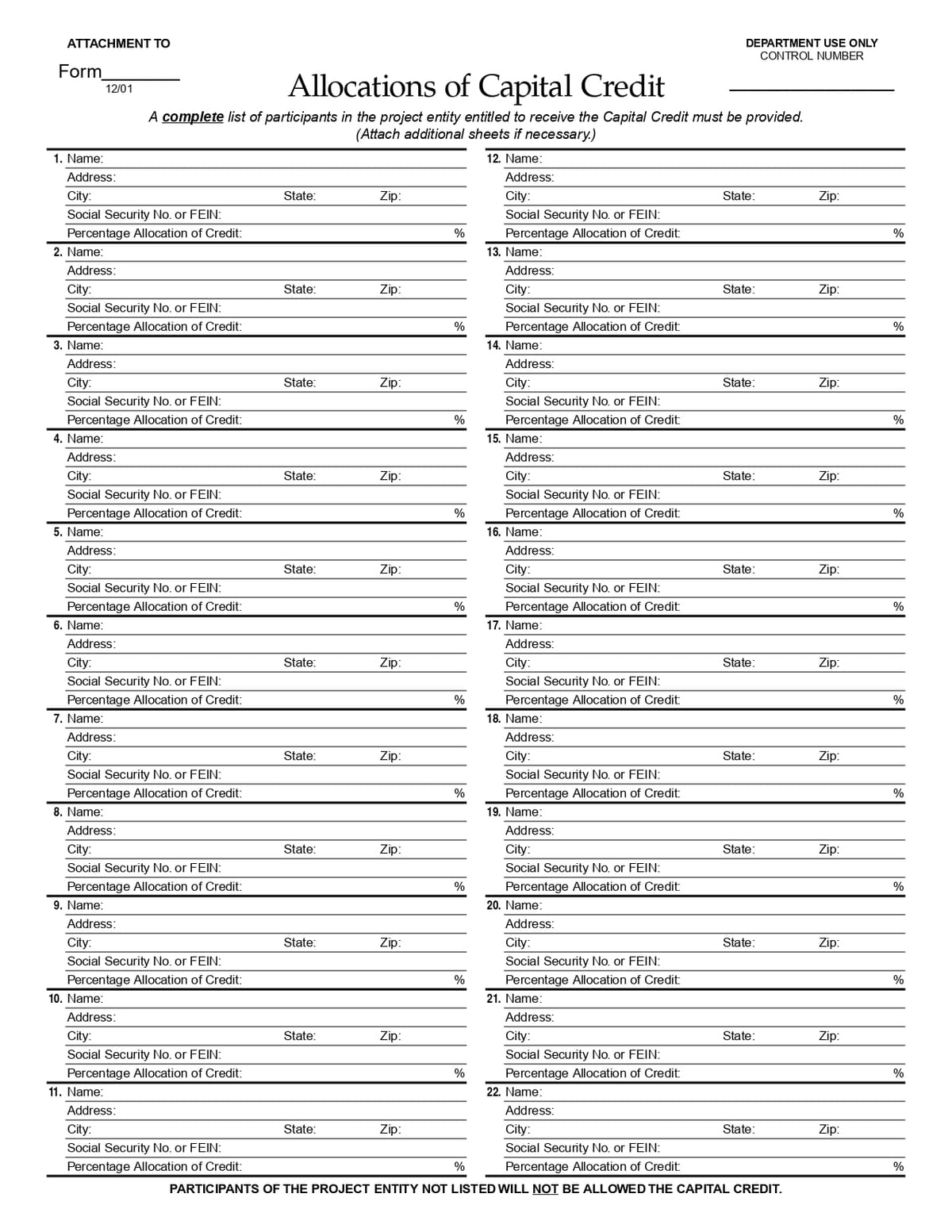

The Allocation Schedule for INT Forms is used to outline the distribution of investment-related tax credits among eligible entities or individuals. Similarly, the Allocation Schedule for Capital Credit of Alabama details the allocation of capital credit benefits for qualifying investments under Alabama’s capital credit program.

No. of Pages : 1

Who Needs the Allocation Schedule for Capital Credit of Alabama Form?

- Businesses in Alabama – Seeking to allocate and claim capital credits for qualifying investments.

- Investors – Who are eligible for capital credits resulting from investments in Alabama-based projects or industries.

- Tax Professionals – Assisting clients in properly documenting and claiming capital credit allocations for tax filings.

- Financial Planners – Helping businesses and investors structure their investments to maximize capital credit benefits.

- Alabama Economic Development Programs – Requiring the form for companies participating in state-backed incentive programs.