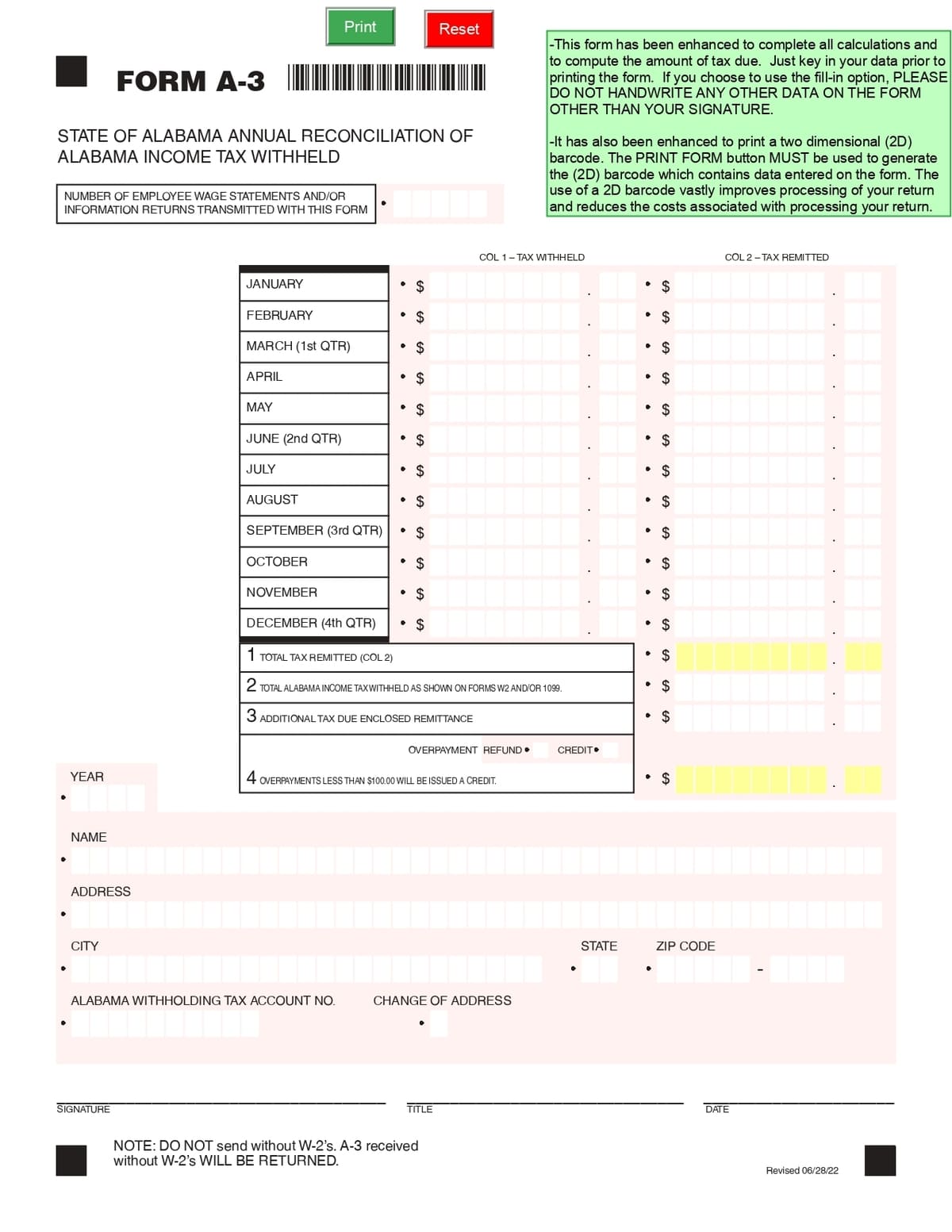

The A-3 Annual Reconciliation of Alabama Income Tax Withheld form is used by employers to report the total amount of state income tax withheld from employees’ wages throughout the year. It reconciles the amounts withheld with the tax payments made to ensure compliance with Alabama’s income tax laws.

No. of Pages : 1

Who Needs the Annual Reconciliation of Alabama Income Tax Withheld Form?

- Employers in Alabama – Required to submit the form to report the total income tax withheld from employees’ wages for the year.

- Payroll Administrators – Managing the reconciliation process for businesses to ensure accurate tax reporting.

- Business Owners – Ensuring compliance with state tax laws by reporting withheld income taxes accurately.

- Tax Professionals – Assisting businesses in preparing and filing the form as part of their annual tax responsibilities.

- Alabama Department of Revenue – To verify that the correct amount of state income tax has been withheld and remitted by employers.