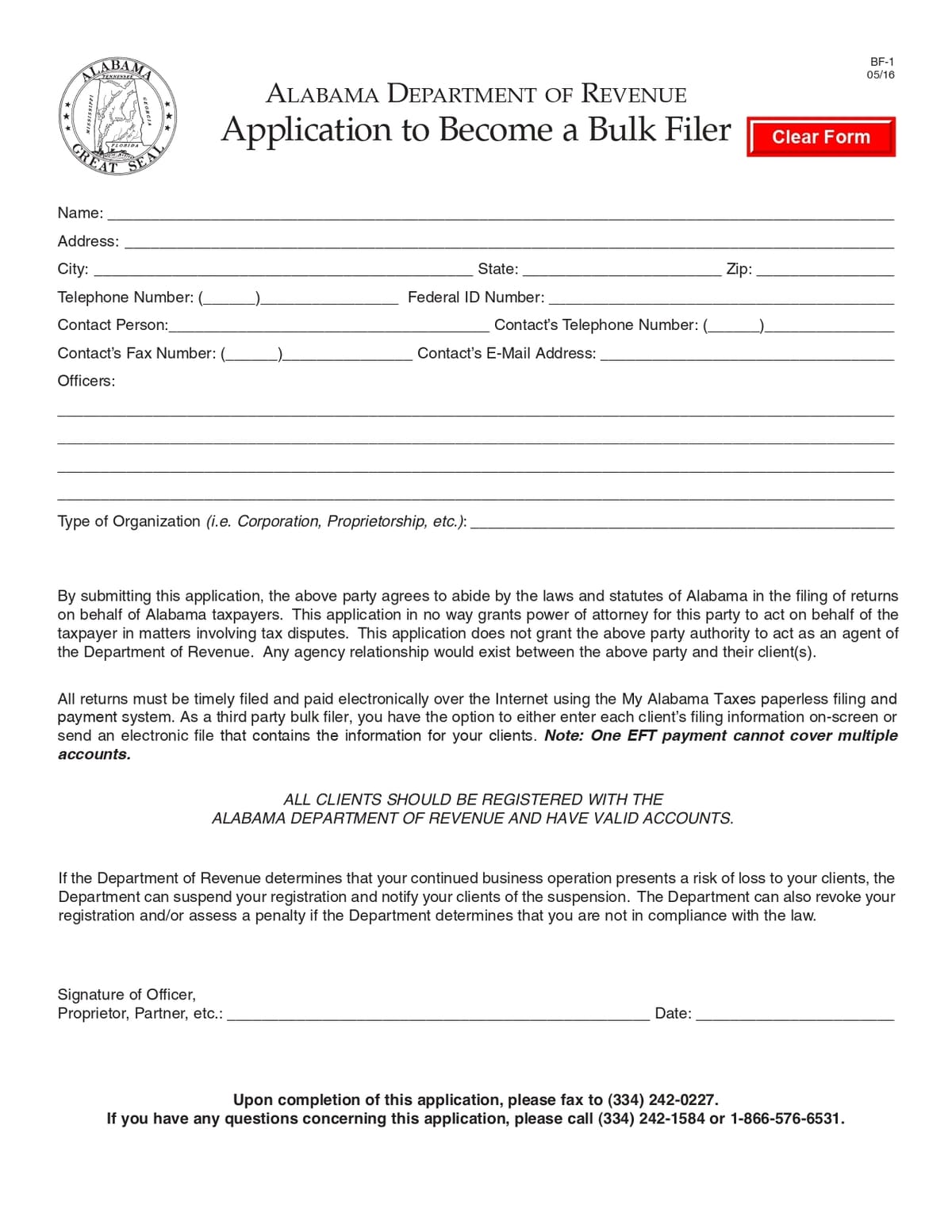

The BF-1 Application to Become a Bulk Filer form is used by businesses or entities seeking approval to file multiple tax returns or payments in bulk to streamline their tax reporting process. It enables eligible filers to submit tax documents for multiple accounts or transactions in a single submission.

No. of Pages : 1

Who Needs the Application to Become a Bulk Filer Form in Alabama?

- Businesses with Multiple Accounts – Seeking to file taxes for multiple entities or locations through a single submission.

- Tax Professionals – Representing clients with numerous tax filings, wishing to simplify the process by filing in bulk.

- Large Employers – Managing payroll for a significant number of employees and needing an efficient filing system.

- Corporations Operating in Multiple Locations – They need to file taxes for various branches or subsidiaries under one bulk submission.

- Software Providers or Third-Party Services – Assisting multiple clients with tax filings and aiming to streamline the process with bulk submissions.