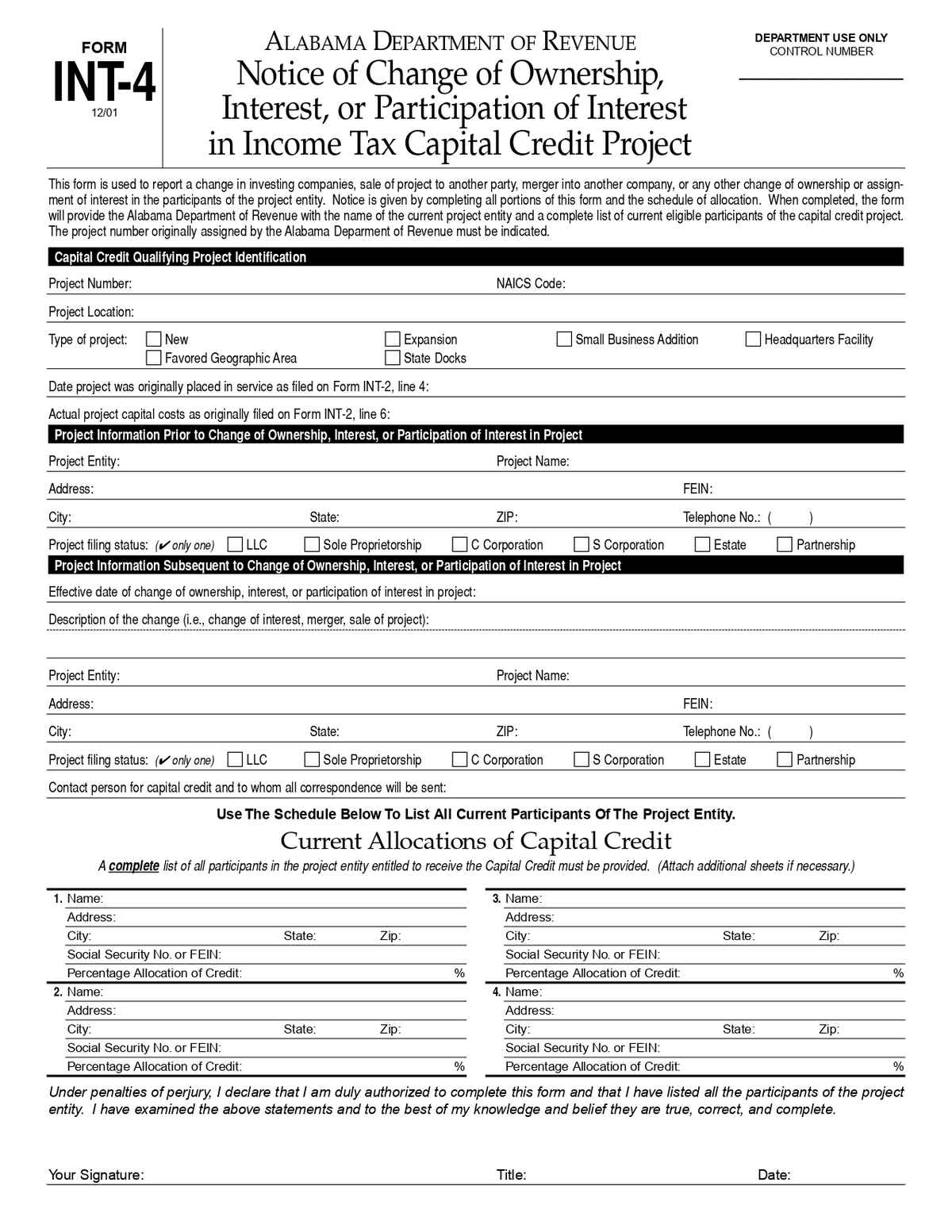

The Alabama Notice of Change of Ownership Form is a legal document used to notify relevant authorities about a change in ownership of a business, property, or vehicle in Alabama. It ensures proper updates to official records for taxation, licensing, or regulatory purposes.

No. of Pages : 2

Who Needs the Alabama Notice of Change of Ownership, Interest, or Participation in Income Tax Capital Credit Project (Form INT-4)?

- Businesses Involved in Capital Credit Projects – Reporting changes in ownership, interest, or participation in projects eligible for income tax capital credits.

- Investors in Tax Credit Projects – Notifying the Alabama Department of Revenue about any changes in their stake or involvement in a capital credit project.

- Tax Credit Project Administrators – Ensuring that ownership or participation changes are properly documented and reported to maintain eligibility for tax benefits.

- Legal and Financial Advisors – Assisting clients with the reporting process when there are changes in their involvement with capital credit projects.

- Alabama Department of Revenue – Receiving updated information to verify and maintain accurate records for tax credits related to capital investments.