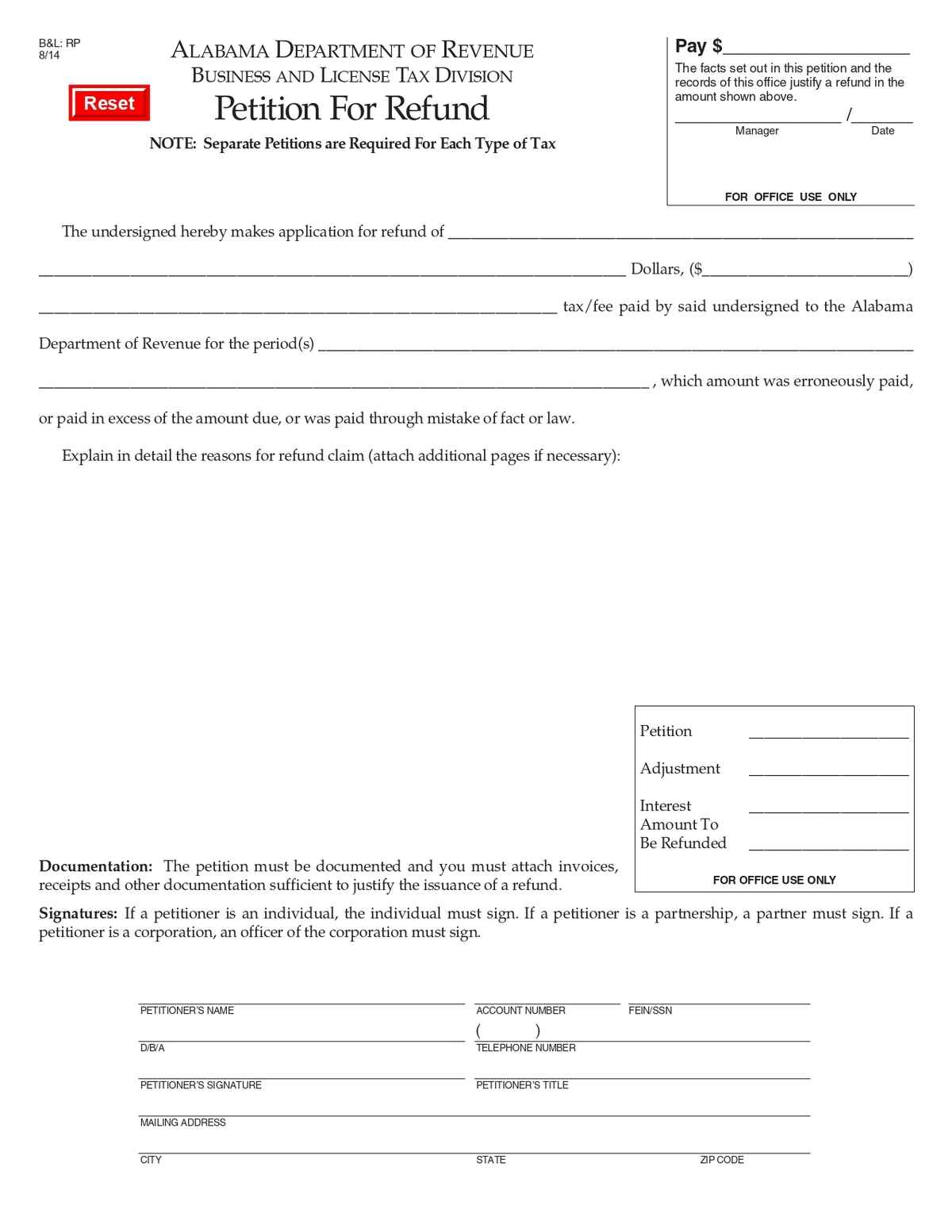

The Alabama Petition for Refund Form is used by taxpayers to request a refund for overpaid state taxes in Alabama. It allows individuals or businesses to formally claim a refund due to errors, overpayments, or adjustments in their tax filings.

No. of Pages : 1

Who Needs the Alabama Petition for Refund B&L RP Form?

- Taxpayers Seeking a Refund – Individuals or businesses who believe they have overpaid taxes and are requesting a refund from the Alabama Department of Revenue.

- Business Owners – Who have overpaid taxes due to errors or adjustments in their business-related tax filings.

- Tax Professionals – Assisting clients with filing petitions for refunds due to tax overpayments or other errors.

- Legal Representatives – Helping clients who need to file a formal request for a refund after overpayment or miscalculation of taxes.

- Companies in Dispute – In cases where businesses need to contest tax liabilities and request a refund of previously paid amounts based on revised assessments.