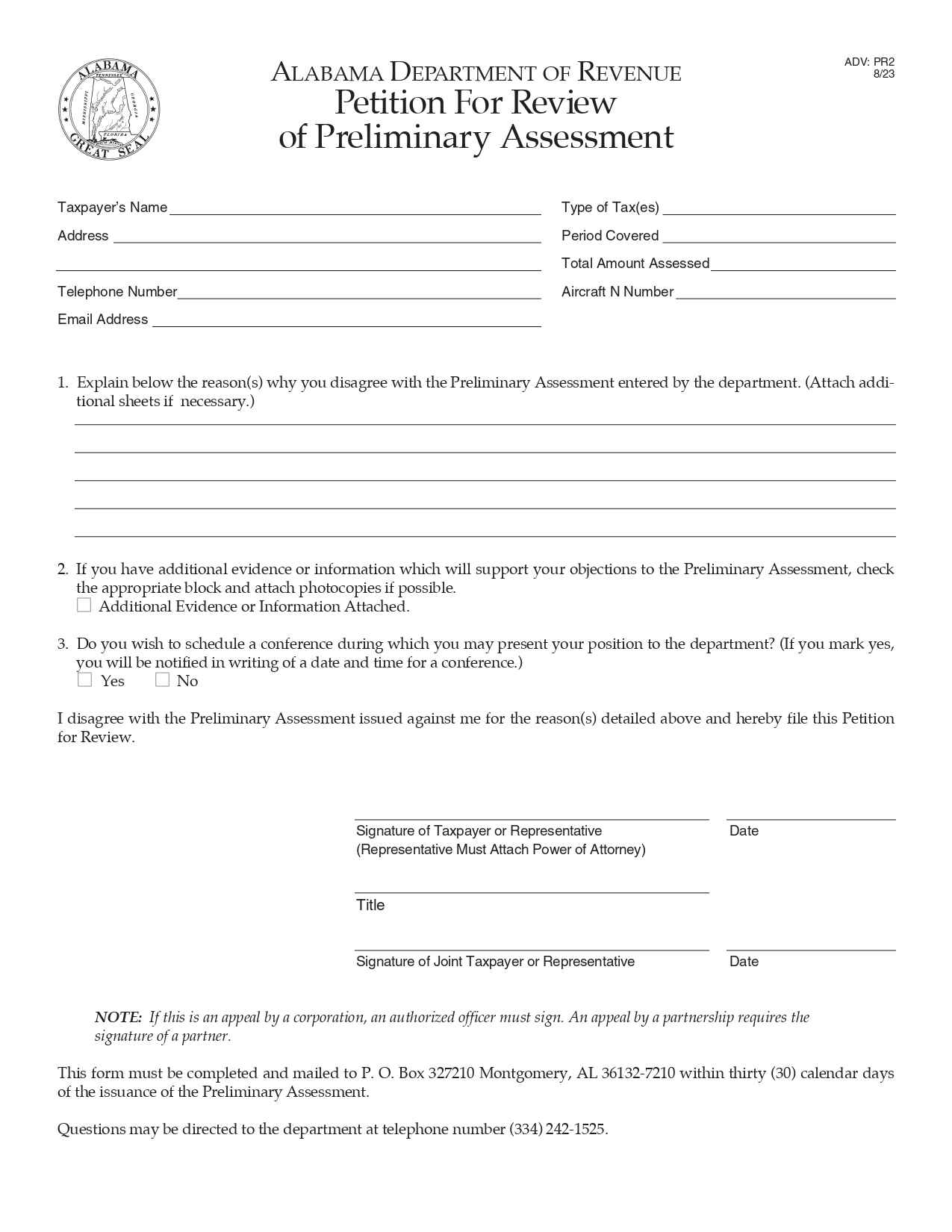

The Alabama Petition for Review of Preliminary Assessment is a legal form used to challenge a preliminary tax assessment issued by the Alabama Department of Revenue. Taxpayers can file this petition to request a review and potentially adjust or dispute the assessed tax amount before it becomes final.

No. of Pages : 1

Who Needs the Alabama Petition for Review of Preliminary Assessment (Form ADV-PR2)?

- Taxpayers Disputing a Preliminary Assessment – Individuals or businesses challenging an initial tax assessment before it becomes final.

- Businesses Facing Additional Tax Liabilities – Seeking to review or contest a tax assessment issued by the Alabama Department of Revenue.

- Tax Professionals – Assisting clients in filing a formal request for a reassessment of their tax obligations.

- Accountants and CPAs – Representing taxpayers in resolving discrepancies in tax assessments.

- Legal Representatives – Advocating for clients in administrative tax disputes before the Alabama Department of Revenue.