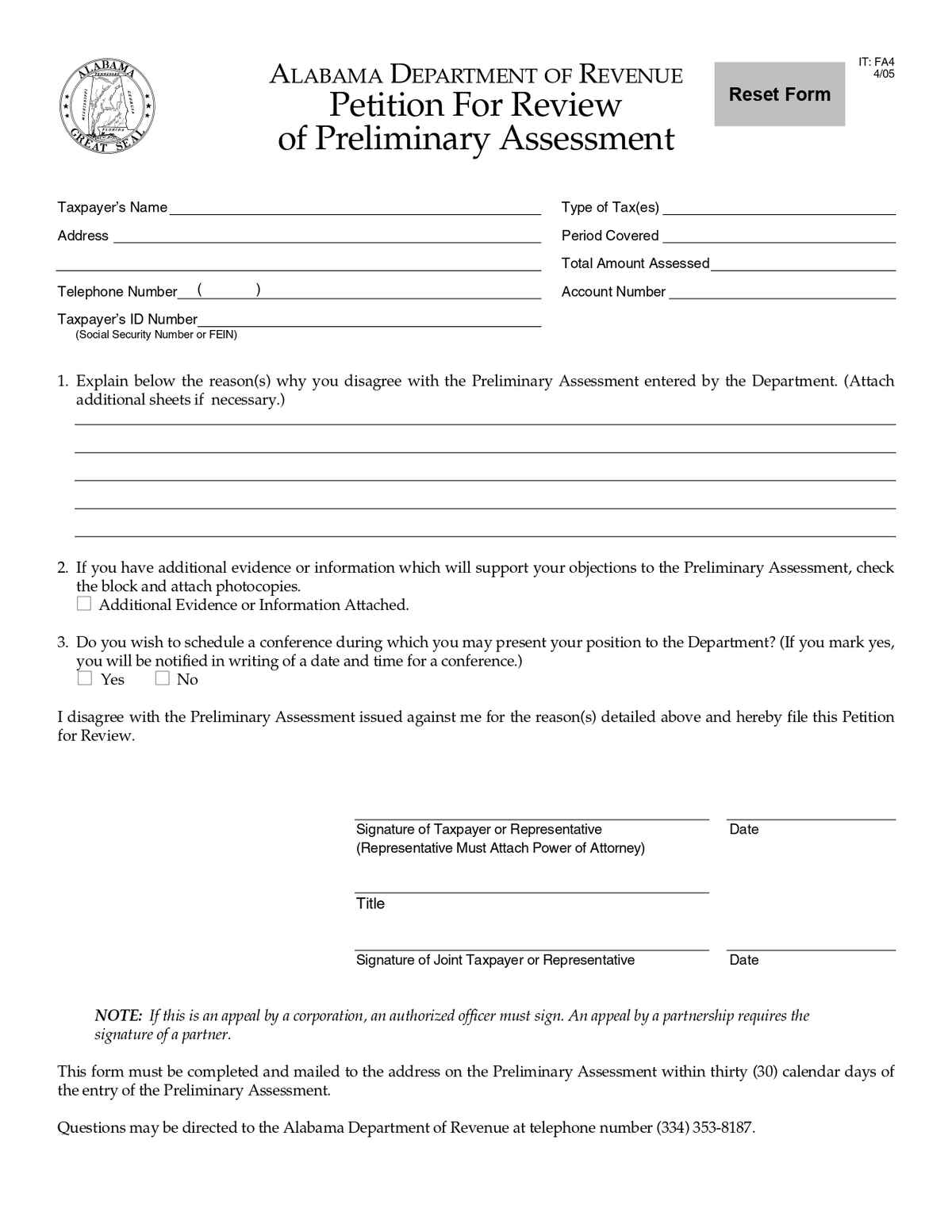

The Alabama Petition for Review of Preliminary Assessment is a legal form used by taxpayers in Alabama to challenge a preliminary tax assessment issued by the Alabama Department of Revenue. This petition allows taxpayers to request a formal review or appeal before the assessment becomes final.

No. of Pages : 1

Who Needs the Alabama Petition for Review of Preliminary Assessment (IT-FA4) Form?

- Taxpayers Disputing a Preliminary Assessment – Individuals or businesses who believe their initial tax assessment from the Alabama Department of Revenue is incorrect.

- Business Owners Facing Tax Liabilities – Seeking to formally challenge or request adjustments before the assessment becomes final.

- Tax Attorneys and Legal Representatives – Assisting clients in filing petitions to dispute preliminary tax assessments.

- Certified Public Accountants (CPAs) and Tax Professionals – Helping taxpayers navigate the review process and provide supporting documentation.

- Corporations and Large Entities – Ensuring compliance and fair taxation by contesting incorrect preliminary assessments issued by the state.