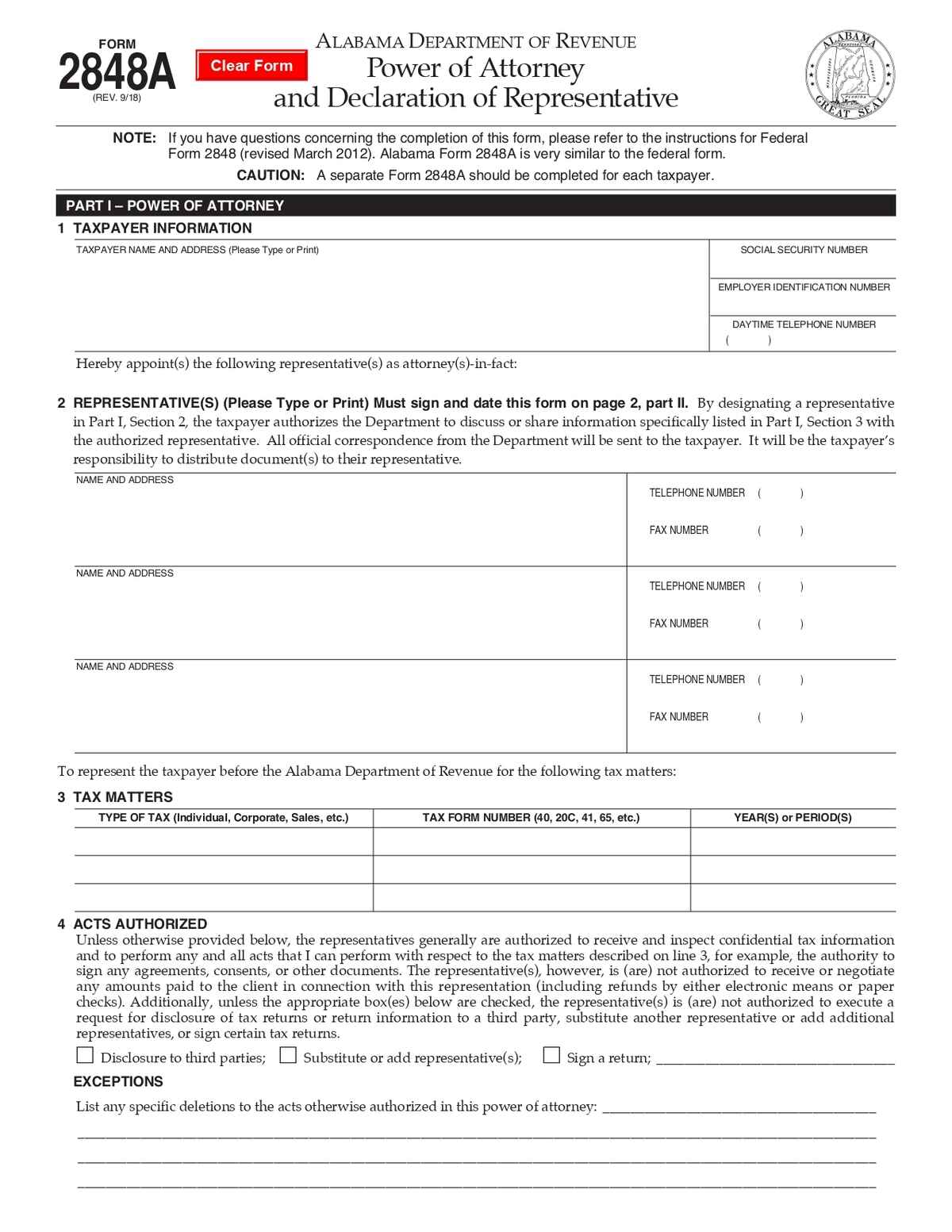

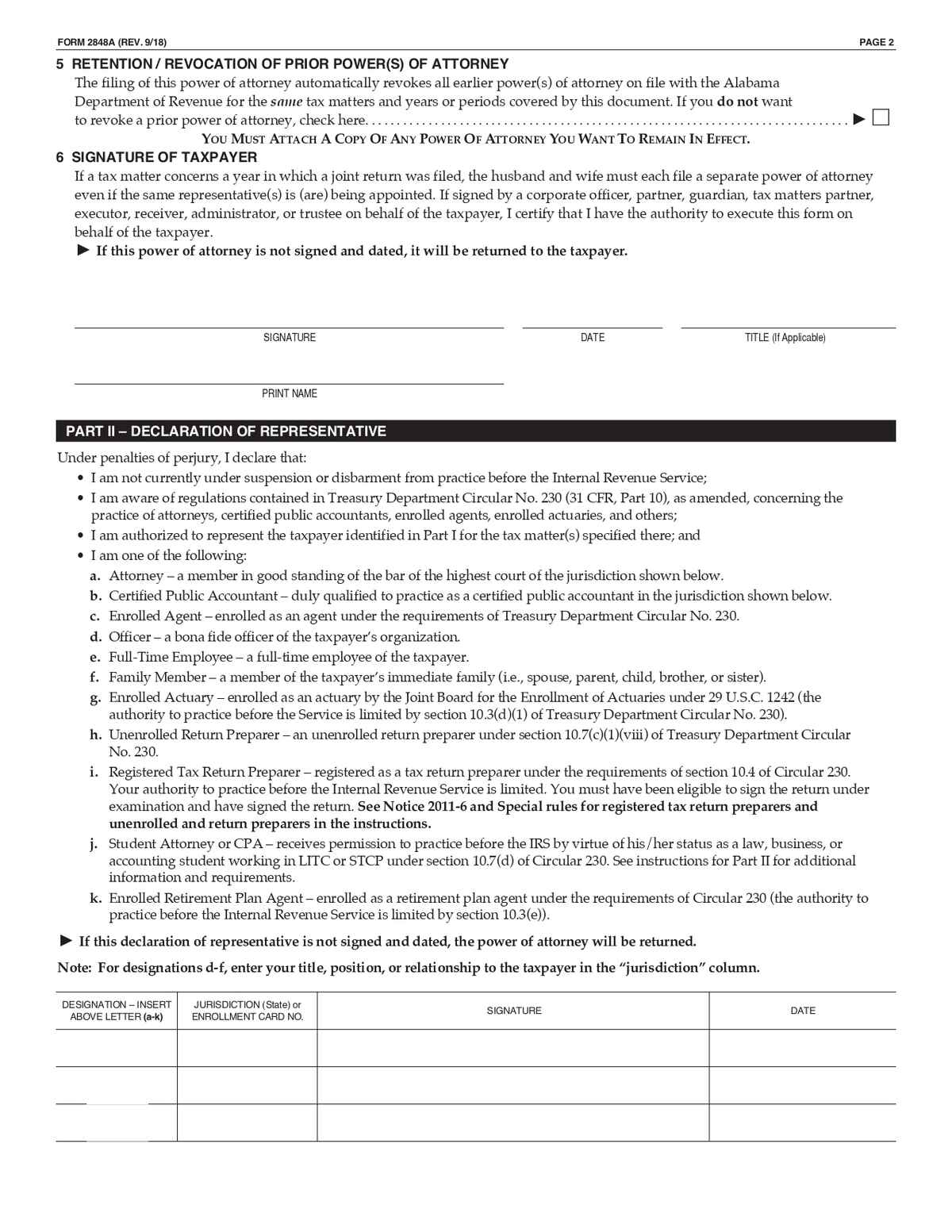

The Alabama Power of Attorney and Declaration of Representative Form allows a taxpayer to authorize an individual, such as an attorney or accountant, to represent them before the Alabama Department of Revenue. It grants specific powers to handle tax matters on the taxpayer’s behalf.

No. of Pages : 2

Who Needs the Alabama Power of Attorney and Declaration of Representative Form?

- Taxpayers Seeking Representation – Individuals or businesses authorizing someone to act on their behalf in tax matters before the Alabama Department of Revenue.

- Certified Public Accountants (CPAs) – Representing clients in tax filings, disputes, or audits.

- Attorneys – Handling legal tax matters and acting on behalf of clients for state tax issues.

- Enrolled Agents – Assisting taxpayers with state tax compliance, filings, and negotiations.

- Business Owners – Delegating tax responsibilities to a trusted representative for communication with tax authorities.