What is a Loan Calculator?

The process of dividing a fixed-rate loan into equal installments is known as loan amortization. Each installment includes interest, with the remainder going toward the loan principle. A loan amortization calculator or table template is the simplest way to compute payments on an amortized loan. Minimum payments may, however, be calculated manually using only the loan amount, interest rate, and loan length.

What is the Use of Loan Calculator Template?

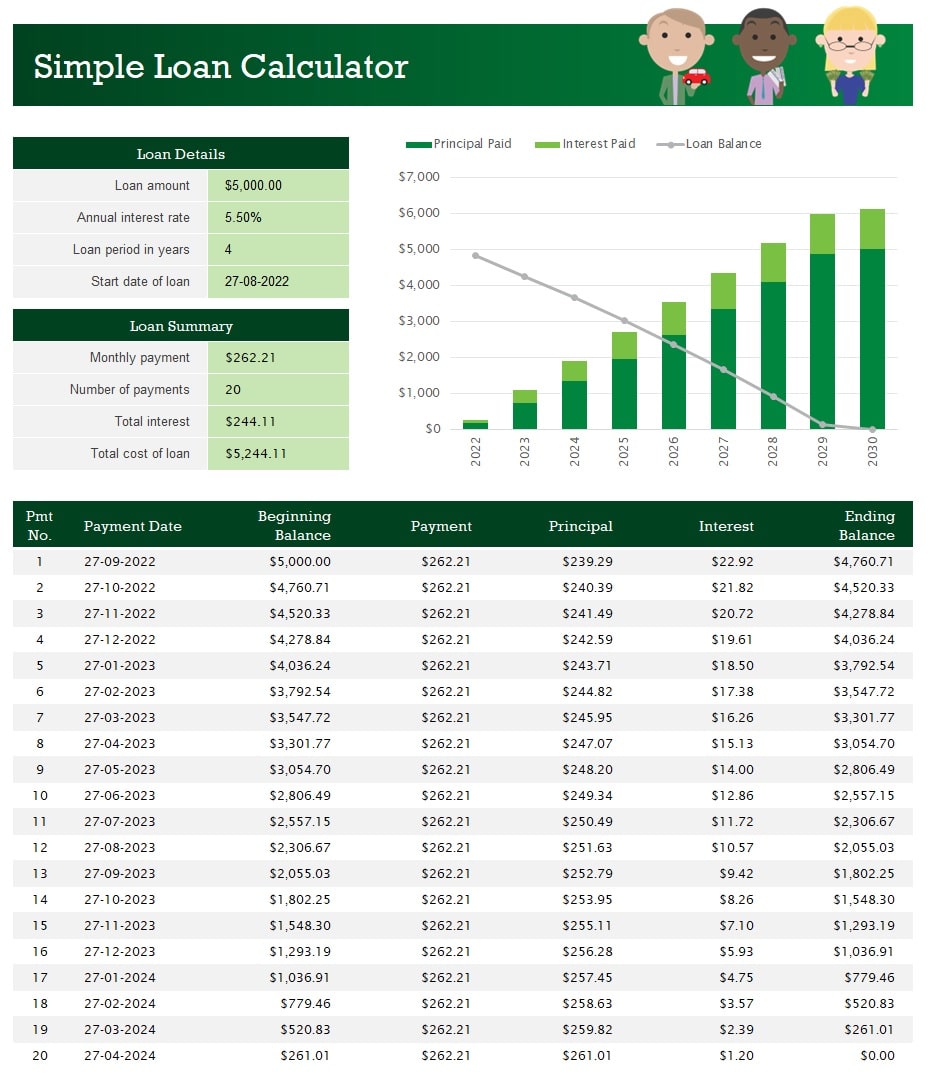

A loan amortization schedule is a detailed chart of monthly loan payments that shows how much principle and interest is included in each level payment until the loan is paid off at the end of its tenure. The majority of each payment goes toward interest early in the schedule; later in the schedule, the majority of each payment begins to cover the loan’s remaining principal.

At some time in your life, you will almost probably need to take out a loan. Whether you’re buying a car or a house, starting a business, consolidating debt, coping with unexpected expenditures, or paying for college, there will be occasions when you need more money than you have saved.

A loan is often a better alternative for a ready supply of cash than a credit card since interest rates on loans are typically much lower than interest rates on credit card purchases. There are certain exceptions to this rule, such as payday loans, but utilizing a loan calculator will help you assess whether the loan you’re contemplating is reasonably priced and appropriate for you.

The File Contains

- LOAN CALCULATOR SHEET

- Loan amount, Annual interest rate, Loan period in years, Start date of the loan, Loan Summary, Monthly payment, Number of payments, Total interest, Total cost of the loan

Loan Calculator Template in Excel (Download.xlsx)