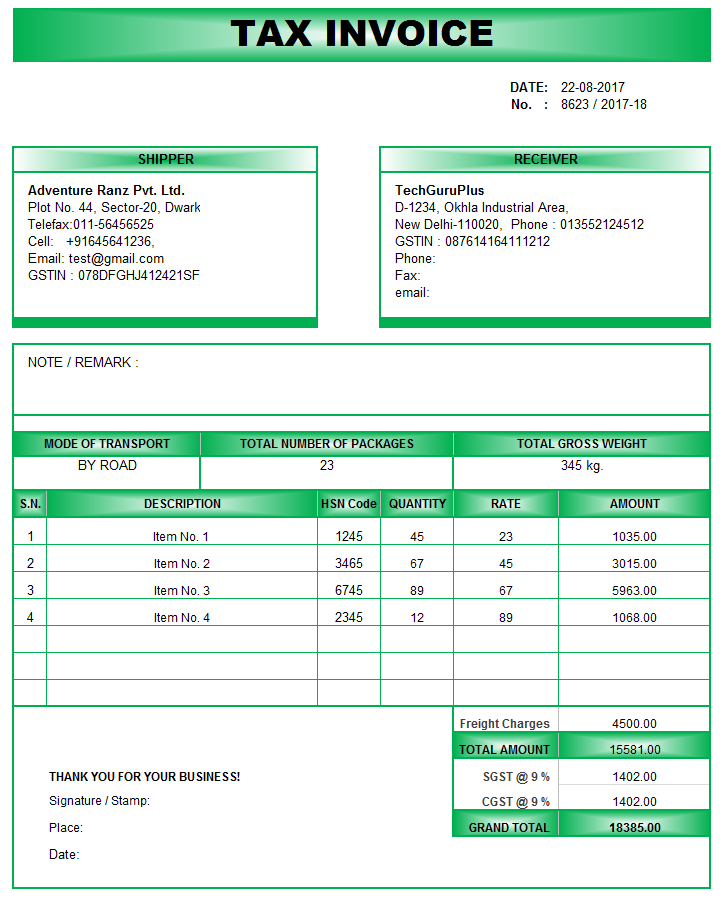

Here is the Preview of GST Invoice

Compulsory Items Required in Tax invoice in GST

| 1 | Name, Address,GSTIN No of Supplier |

| 2 | Unique Serial Number of Each Invoice in one or multiple series (Can have Dash -orSlash /.But it should be different series for each year |

| 3 | Date of Issue of Invoice |

| 4 | Name , Address ,GSTIN of Supplier If Registered |

| 5 | In Case of Unregistered Buyer, Name, Address, State, Place of Delivery is compulsorily required if Invoice Value before taxes is more than 50000 |

| 6 | HSN Code of Goods |

| 7 | Description of Goods |

| 8 | Quantity as well as Quantity Code or Units |

| 9 | Total Value |

| 10 | Discount if any and Taxable Value (Total Value-Discount) |

| 11 | Rate of Tax (Separately show CGST, SGST, without IGST, UTGST, Cess if any) |

| 12 | Place of Supply (It is required For Interstate Sales) |

| 13 | Address for Delivery |

| 14 | Whether Tax is Payable Under Reverse Charge |

| 15 | Signature/Digital Signature of Authorized Signatory |

(Excel, Word, PDF, JPEG in one zip file)