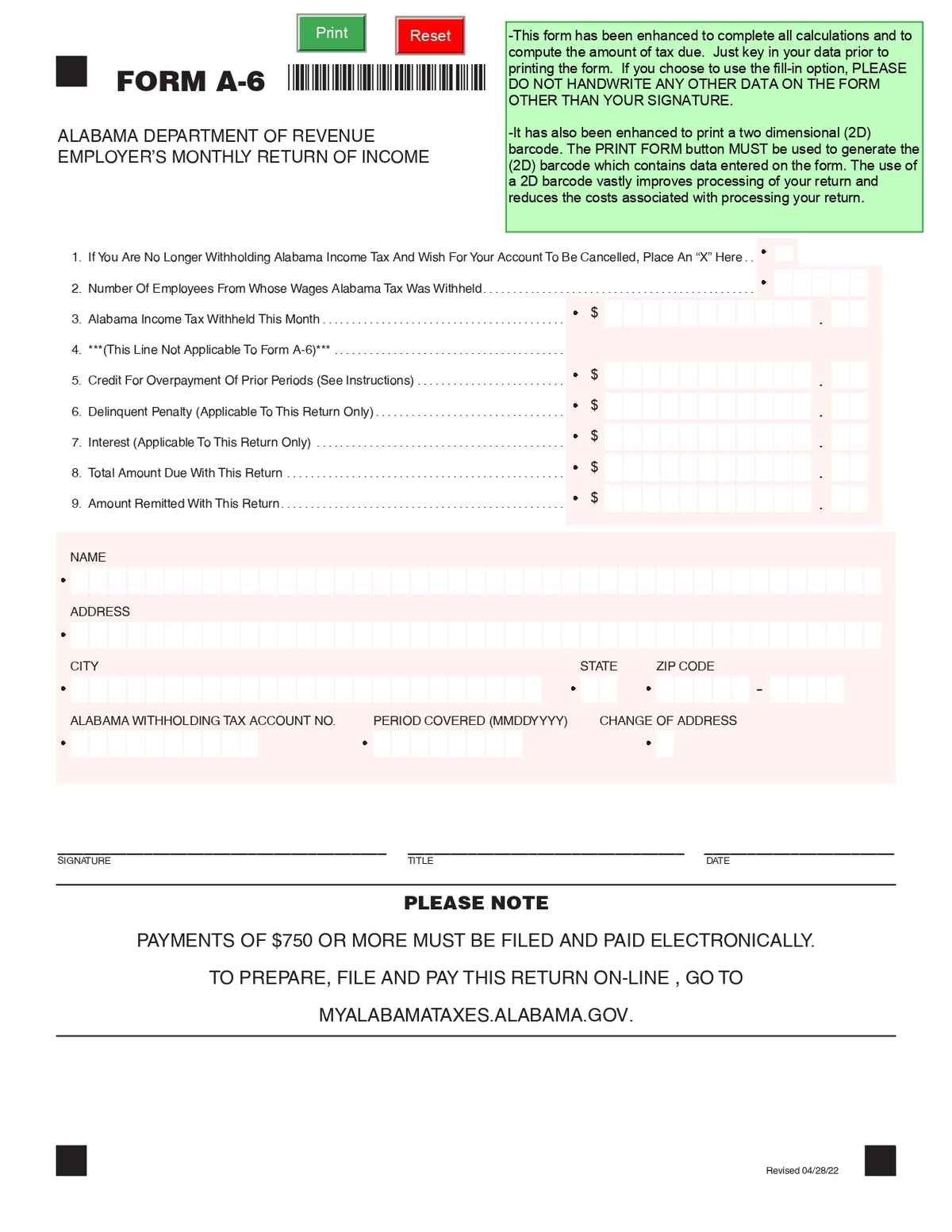

The Employer’s Monthly Return of Income Tax Withheld (Form A-6) is a tax form used by employers in Alabama to report and remit state income taxes withheld from employees’ wages. It must be filed monthly with the Alabama Department of Revenue to ensure compliance with state tax regulations.

No. of Pages : 1

The Employer’s Monthly Return of Income Tax Withheld form in Alabama is required for employers who withhold state income tax from their employee’s wages. This includes:

- Businesses and Organizations – Any employer registered with the Alabama Department of Revenue (ADOR) that has employees and withholds state income tax.

- Self-Employed Individuals with Employees – If a sole proprietor, freelancer, or small business owner hires employees and withholds taxes.

- Corporations, Partnerships, and LLCs – Any business entity with employees subject to Alabama state income tax withholding.

- Nonprofit Organizations – If they have paid employees subject to state tax withholding.