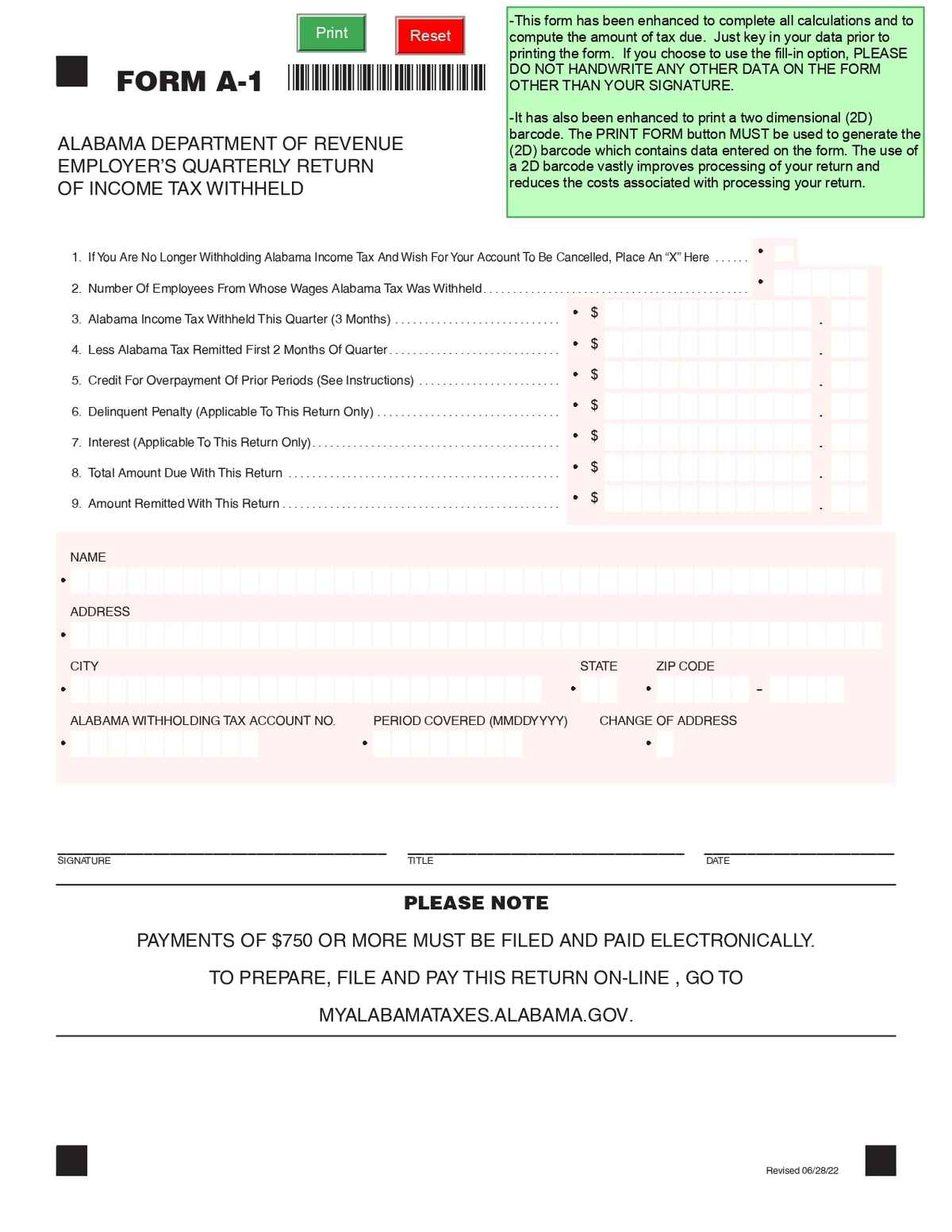

The Employer’s Quarterly Return of Income Tax Withheld A-1 Form in Alabama is used by employers to report the amount of income tax withheld from employees’ wages during a specific quarter. It ensures that employers comply with state tax requirements by submitting the withheld taxes to the Alabama Department of Revenue.

No. of Pages : 1

Who Needs the Alabama Employer’s Quarterly Return of Income Tax Withheld (A-1) Form?

- Employers in Alabama – Required to report and remit state income tax withheld from employees’ wages on a quarterly basis.

- Payroll Administrators – Managing employee tax withholdings and ensuring timely tax reporting.

- Business Owners – Responsible for complying with Alabama state tax laws regarding employee wage withholdings.

- Accounting and Tax Professionals – Assisting businesses in preparing and filing the A-1 form to meet quarterly tax obligations.

- Human Resources Departments – Ensuring accurate reporting of employee income tax withholdings and compliance with state tax regulations.