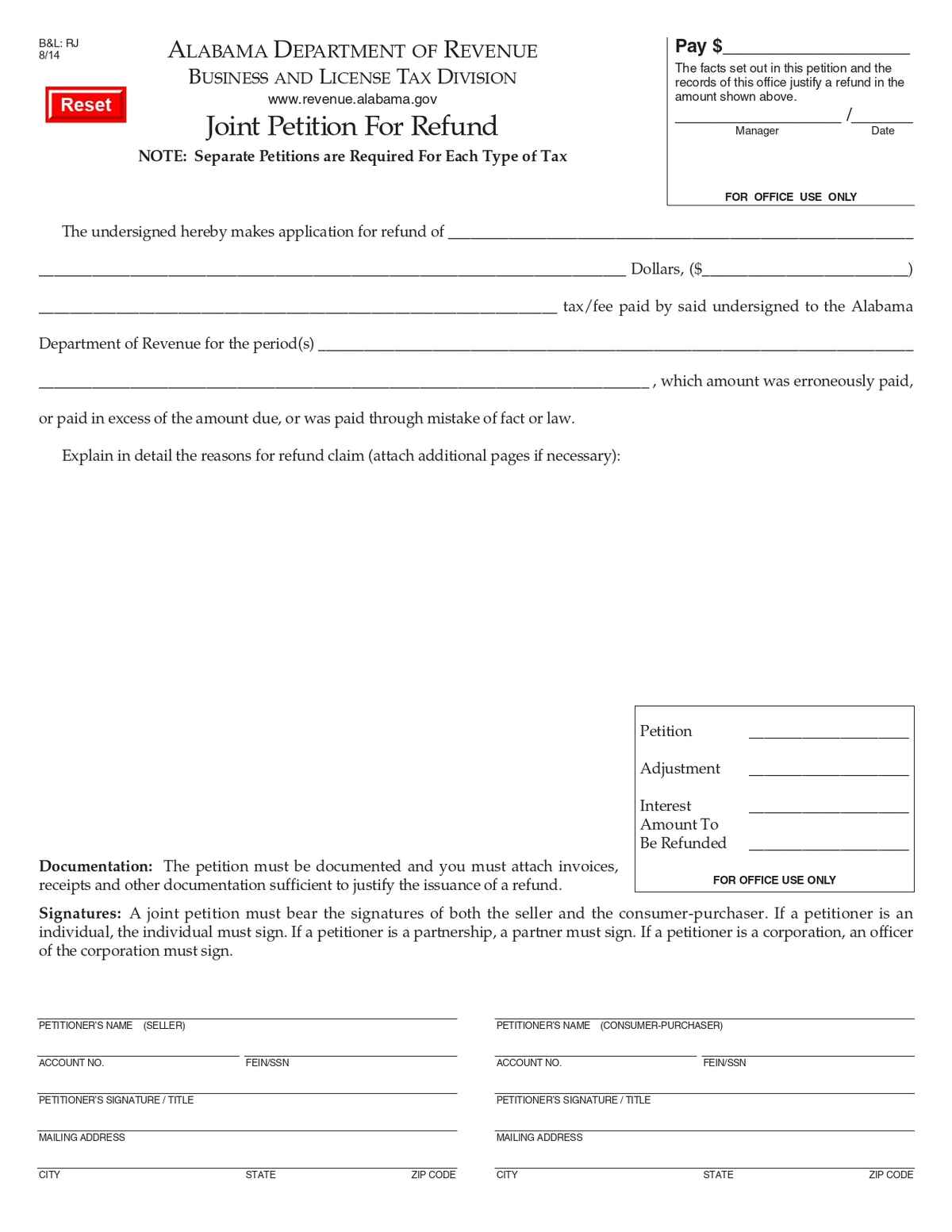

The Alabama Joint Petition for Refund Form is used when multiple parties, such as a taxpayer and the Alabama Department of Revenue, jointly request a refund for overpaid taxes. It streamlines the refund process by ensuring both parties agree on the amount and eligibility before submission.

No. of Pages : 1

Who Needs the Alabama Joint Petition for Refund Form?

- Taxpayers Requesting a Refund – Individuals or businesses that have overpaid taxes and need to file a formal refund request.

- Businesses Seeking Tax Adjustments – Companies that identify excess tax payments and wish to recover the overpaid amount.

- Tax Professionals and Accountants – Assisting clients in preparing and submitting refund claims for tax overpayments.

- Legal Representatives – Acting on behalf of taxpayers to negotiate and file a joint refund petition with the Alabama Department of Revenue.

- Government Entities and Revenue Officials – Facilitating agreed-upon tax refunds to eligible