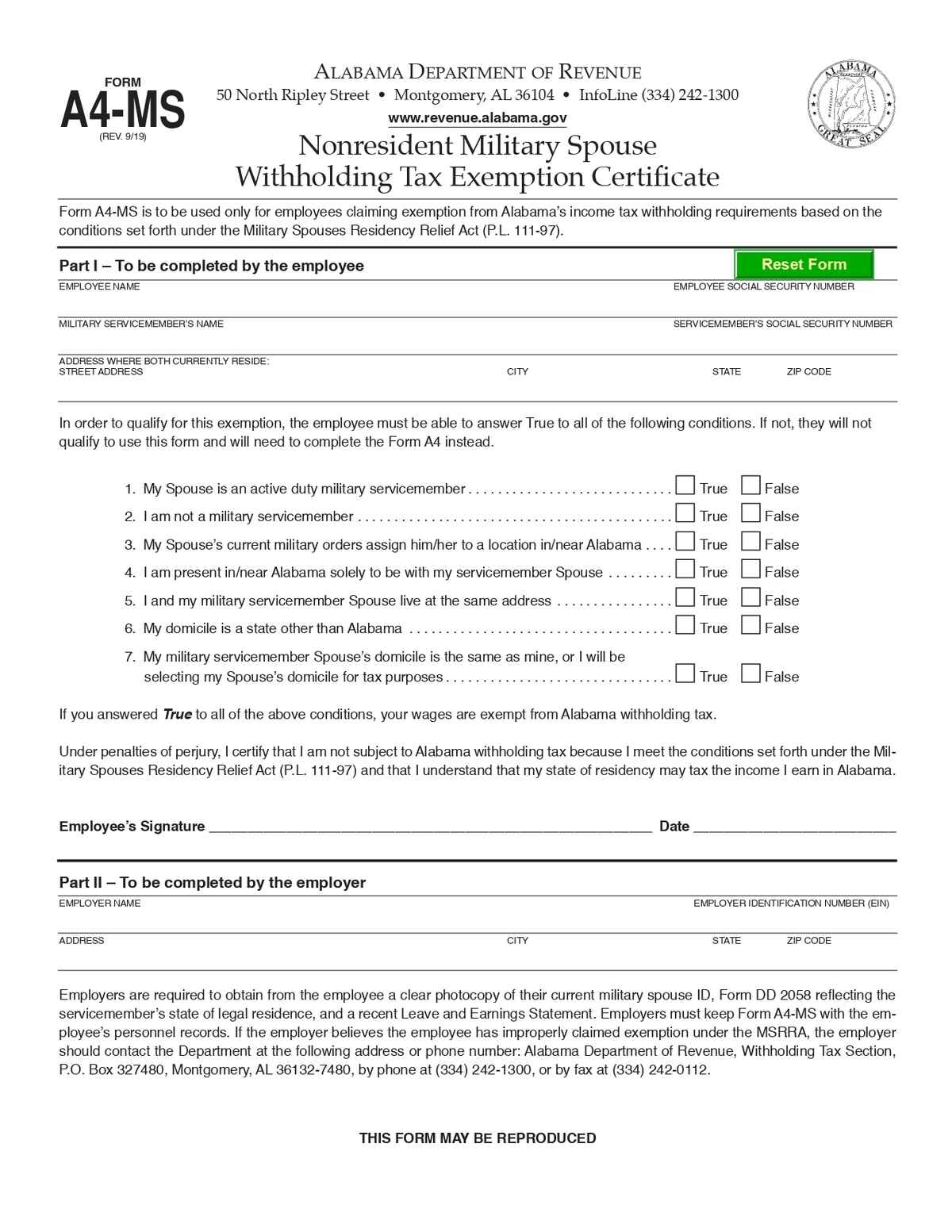

The Alabama Military Spouse A4-MS Form is an assessment form used for tax withholding purposes for military spouses working in Alabama. It allows eligible spouses to claim exemption from Alabama state income tax under the Military Spouses Residency Relief Act (MSRRA).

No. of Pages : 1

Who Needs the Alabama Military Spouse (A4-MS) Form?

- Military Spouses Residing in Alabama – Claiming exemption from Alabama state income tax due to residency in another state.

- Active-duty service Members’ Spouses – Who meets the requirements under the Military Spouses Residency Relief Act (MSRRA).

- Employers in Alabama – Needing documentation to properly adjust state tax withholdings for eligible military spouses.

- Payroll Administrators – Ensuring compliance with tax exemption rules for military spouses.

- Tax Professionals – Assisting military families in properly claiming their exemption from Alabama state income tax.