If there are no transactions for a long time, a bank account may go dormant. You must apply to the bank and provide the necessary paperwork, such as evidence of identification and address, in order to reactivate it. Five application formats that are suited to various situations are provided below to aid you in the process.

1. General Application for Dormant Account Activation

To,

The Branch Manager,

[Bank Name],

[Branch Address],

[City, State, Pin Code]

Date: [Insert Date]

Subject: Request for Activation of Dormant Bank Account

Respected Sir/Madam,

I am [Your Name], holding a savings account with your bank, Account Number [Your Account Number]. Due to [reason, e.g., prolonged non-usage or overseas relocation], my account has been marked as dormant.

I kindly request you to reactivate my account so I may resume using it for regular transactions. Attached are the necessary documents for your reference:

1. Identity proof (e.g., Aadhaar, PAN card).

2. Address proof (e.g., utility bill, driving license).

I have also attached a self-attested copy of my passbook. Please let me know if additional information is required.

Yours sincerely,

[Your Name]

[Your Contact Number]

[Your Email Address]

2. Application for Dormant Account Activation Due to Job Relocation

To,

The Branch Manager,

[Bank Name],

[Branch Address],

[City, State, Pin Code]

Date: [Insert Date]

Subject: Request for Reactivation of Dormant Account After Job Relocation

Respected Sir/Madam,

I am [Your Name], an account holder at your branch with Account Number [Your Account Number]. My account was marked dormant because I could not maintain regular transactions after relocating to [New City/State] for my job.

Now that I have settled, I would like to reactivate my account for regular use. Please find the following documents enclosed for your reference:

1. Identity proof (e.g., Aadhaar, PAN card).

2. Address proof of my new residence.

3. Recent photograph.

Kindly process my request at the earliest, and let me know if further documents are required.

Yours sincerely,

[Your Name]

[Your Contact Number]

[Your Email Address]

3. Application for Dormant Account Activation After Overseas Relocation

To,

The Branch Manager,

[Bank Name],

[Branch Address],

[City, State, Pin Code]

Date: [Insert Date]

Subject: Request for Activation of Dormant Account After Return from Abroad

Respected Sir/Madam,

I am [Your Name], an account holder of your bank with Account Number [Your Account Number]. My account has been dormant as I was living abroad for [duration] due to [reason, e.g., work or studies].

Now that I have returned to India, I wish to reactivate my account for regular use. I have enclosed the following documents for your reference:

1. Identity proof (e.g., passport, Aadhaar card).

2. Address proof (e.g., rental agreement, utility bill).

3. A copy of my bank passbook.

Please let me know if any additional details are required to process my request.

Yours sincerely,

[Your Name]

[Your Contact Number]

[Your Email Address]

4. Application for Dormant Account Activation for Family Member

To,

The Branch Manager,

[Bank Name],

[Branch Address],

[City, State, Pin Code]

Date: [Insert Date]

Subject: Request for Reactivation of Dormant Account for Family Member

Respected Sir/Madam,

I am [Your Name], writing on behalf of [Family Member’s Name], who is the account holder of Account Number [Account Number]. Due to [reason, e.g., illness or old age], they have not been able to use their account, and it has become dormant.

I request you to reactivate their account so they may resume its use. Enclosed are the required documents:

1. Identity proof and address proof of the account holder.

2. Authorization letter from the account holde

3. My identity proof for verification.

Thank you for your assistance in reactivating the account.

Yours sincerely,

[Your Name]

[Your Contact Number]

[Your Relationship to the Account Holder]

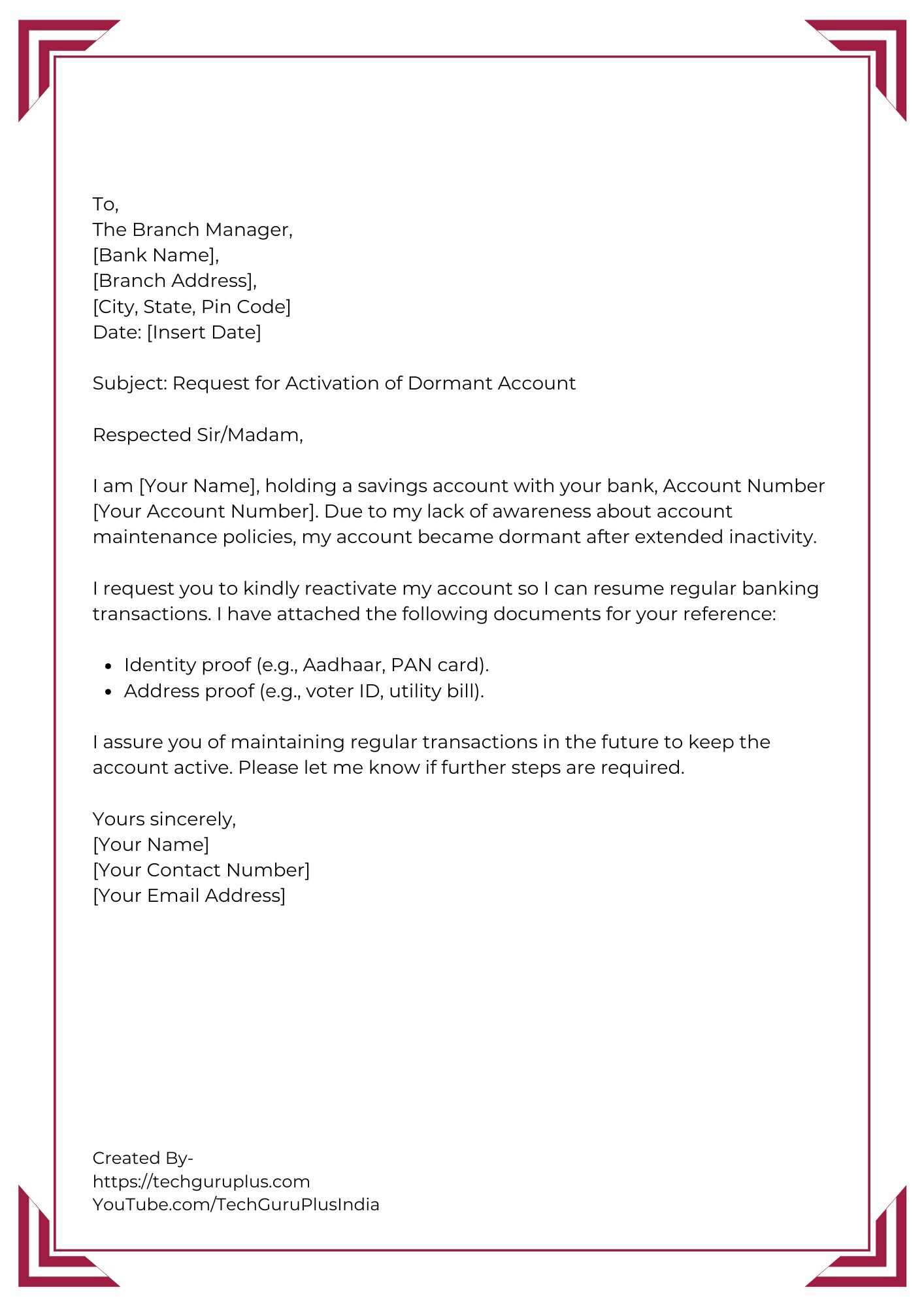

5. Application for Dormant Account Activation Due to Lack of Awareness

To,

The Branch Manager,

[Bank Name],

[Branch Address],

[City, State, Pin Code]

Date: [Insert Date]

Subject: Request for Activation of Dormant Account

Respected Sir/Madam,

I am [Your Name], holding a savings account with your bank, Account Number [Your Account Number]. Due to my lack of awareness about account maintenance policies, my account became dormant after extended inactivity.

I request you to kindly reactivate my account so I can resume regular banking transactions. I have attached the following documents for your reference:

1. Identity proof (e.g., Aadhaar, PAN card).

2. Address proof (e.g., voter ID, utility bill).

I assure you of maintaining regular transactions in the future to keep the account active. Please let me know if further steps are required.

Yours sincerely,

[Your Name]

[Your Contact Number]

[Your Email Address]

Key Points to Consider

Reason for Dormancy: Be prepared to explain why the account became inactive.

Required Documents: Provide identity proof, address proof, and your dormant account details.

Bank’s Policy: Some banks may require you to make a transaction or visit the branch for reactivation.

Contact the Bank: Reach out to your branch or customer service to confirm the reactivation process.

Account Usage: Start transacting regularly after reactivation to prevent future dormancy.

If you submit a formal application together with the required paperwork, reactivating a dormant bank account is an easy process. The bank will handle your request more quickly if you provide a clear explanation of the cause for inactivity.

To keep your account accessible and avoid future inactivity, regular transactions are essential. Keep up with your bank’s policies and keep a close eye on account activities.

You may guarantee a simple and easy reactivation process by adhering to these guidelines and using the right format.