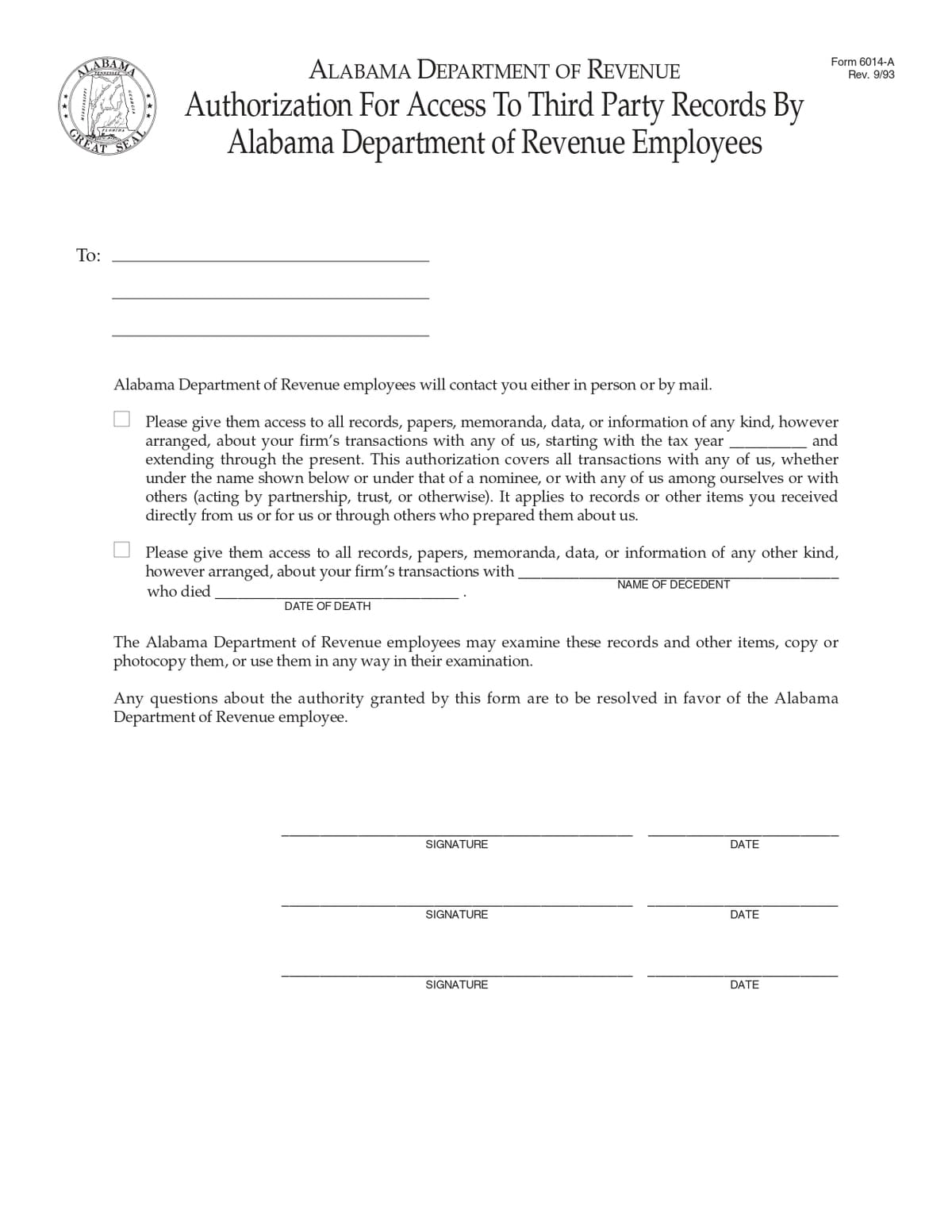

The Form 6014-A Authorization for Access to Third Party Records allows the Alabama Department of Revenue to access an individual’s or business’s third-party records, such as financial documents, for audit or compliance purposes. It grants permission for the department’s employees to obtain necessary information directly from third-party sources.

No. of Pages : 1

Who Needs the Authorization for Access to Third Party Records by Alabama Form?

- Businesses Undergoing Audits – Requiring third-party records for verification or investigation of financial transactions.

- Taxpayers Subject to Review – Who need to grant the Alabama Department of Revenue access to their third-party records for tax compliance purposes

- Accountants and Tax Advisors – Assisting clients with tax audits or disputes, and needing to authorize access to third-party records on their behalf.

- Financial Institutions – Involved in providing records to the Alabama Department of Revenue as part of an investigation or audit.

- Legal Representatives – Acting on behalf of individuals or businesses to provide access to third-party records for tax-related matters.