One of the most crucial financial decisions you will make as a parent is to invest in your child’s education. With the cost of education on the rise, it’s critical to prepare for and secure their future. Using Systematic Investment Plans (SIPs) is one of the most efficient ways of doing this.

What are SIPs?

SIPs or (Systematic Investment Plan) are a simple way to invest your money in mutual funds. Instead of putting in a large amount all at once, you invest small amounts regularly, like every month. This makes it easier to start investing and helps you build wealth over time. SIPs also reduce the risk of buying at a high price because you spread your investments over time.

How does it Work?

- Decide Your Monthly Investment: You choose an amount (e.g., ₹5,000) to invest every month.

- Automatic Investment: This amount is taken from your bank account automatically and invested in a mutual fund.

- Buy More Units When Prices Are Low: If the mutual fund price is low, your ₹1,000 buys more units. Example: If the price is ₹80 per unit, you get 62.5 units (₹5,000 ÷ ₹80).

- Buy Fewer Units When Prices Are High: If the mutual fund price is high, your ₹1,000 buys fewer units. Example: If the price is ₹100 per unit, you get 50 units (₹5,000 ÷ ₹100).

- Grow Over Time: As you invest regularly, the number of units you own increases, helping your money grow for long-term goals.

Why Choose SIPs for Children’s Future?

- Regular Savings: SIPs help you save money regularly. By investing a fixed amount every month, you’re not just saving but also helping your money grow.

- Power of Compounding: The sooner you start investing, the more your money can grow because of compounding. Even small amounts can become big over time.

- Flexibility: SIPs are flexible. You can start with a small amount and increase it as you earn more or have extra money.

- Goal-Based Investing: You can use SIPs to save for specific goals, like your child’s education. You can pick funds that suit how much risk you’re comfortable with and how long you want to invest.

How to Get Started with SIPs for Your Child’s Education

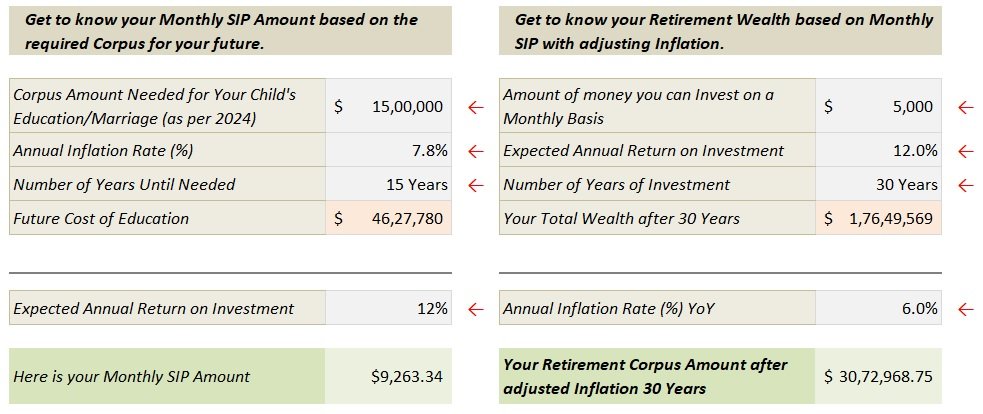

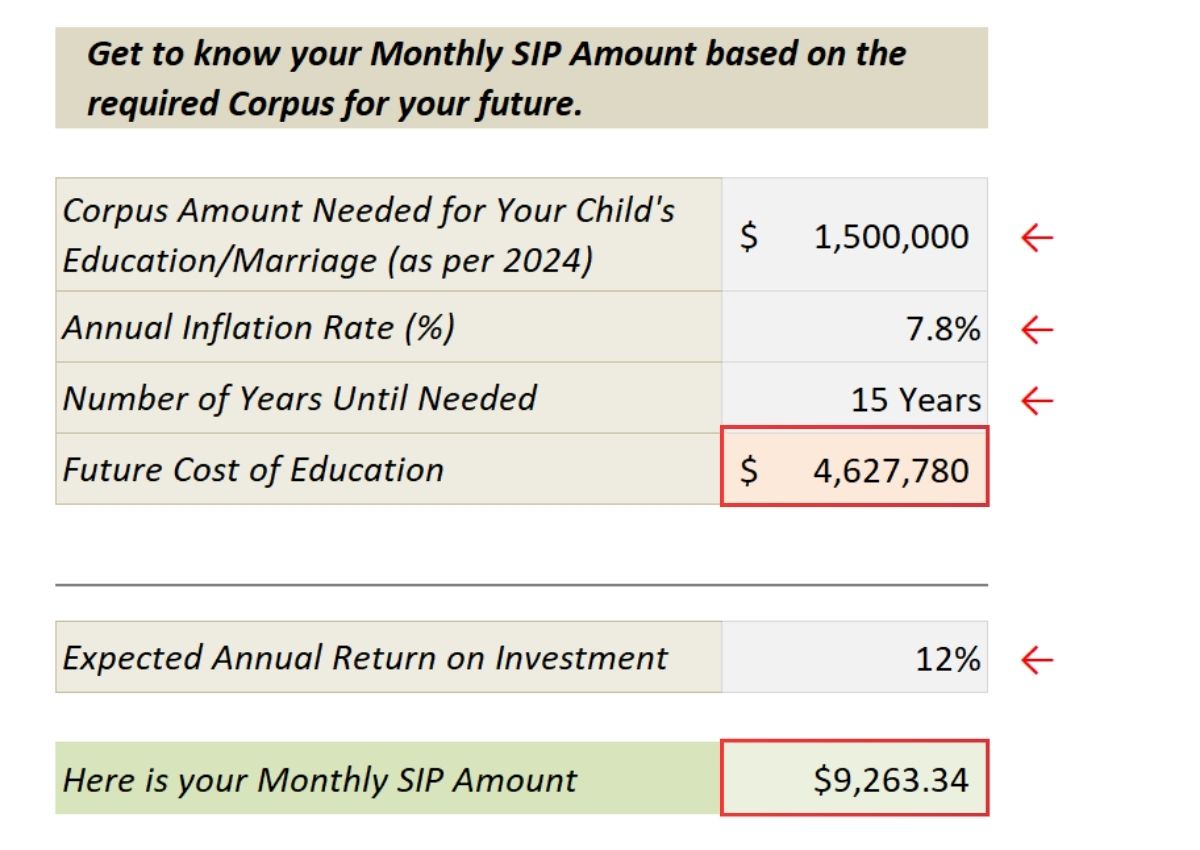

Planning for your child’s future starts with understanding how much you need to invest today. Let’s break it down:

- Estimate the Corpus Needed

First, figure out the current cost of your child’s education or marriage. For example, if the estimated cost is ₹15,00,000 today, that’s your starting point. - Factor in Inflation

Education costs will rise with inflation. Assuming an annual inflation rate of 7.8%, the future cost of this ₹15,00,000 education will grow to about ₹46,27,780 in 15 years. - Calculate Monthly SIP

To accumulate ₹46,27,780, you need to invest in SIPs. Assuming an expected annual return of 12%, your monthly SIP amount comes out to ₹9,263.34. - Start Your SIP

Now that you know how much to invest monthly, you can start your SIP. Regularly investing ₹9,263.34 each month for 15 years can help you reach your goal.

To make your planning even easier, I’ve attached an Excel template that you can use to calculate your own monthly SIP amount based on your financial goals. Click the link below to download the file and start planning for your child’s future today!

Retire Early with Smart Financial Planning: How SIPs Can Build Your Retirement Wealth

For those of us with regular jobs, planning for retirement can feel confusing. However, with Systematic Investment Plans (SIPs) in mutual funds, you can steadily grow your retirement savings. Let’s see how you can build your wealth through monthly SIPs, even after accounting for inflation.

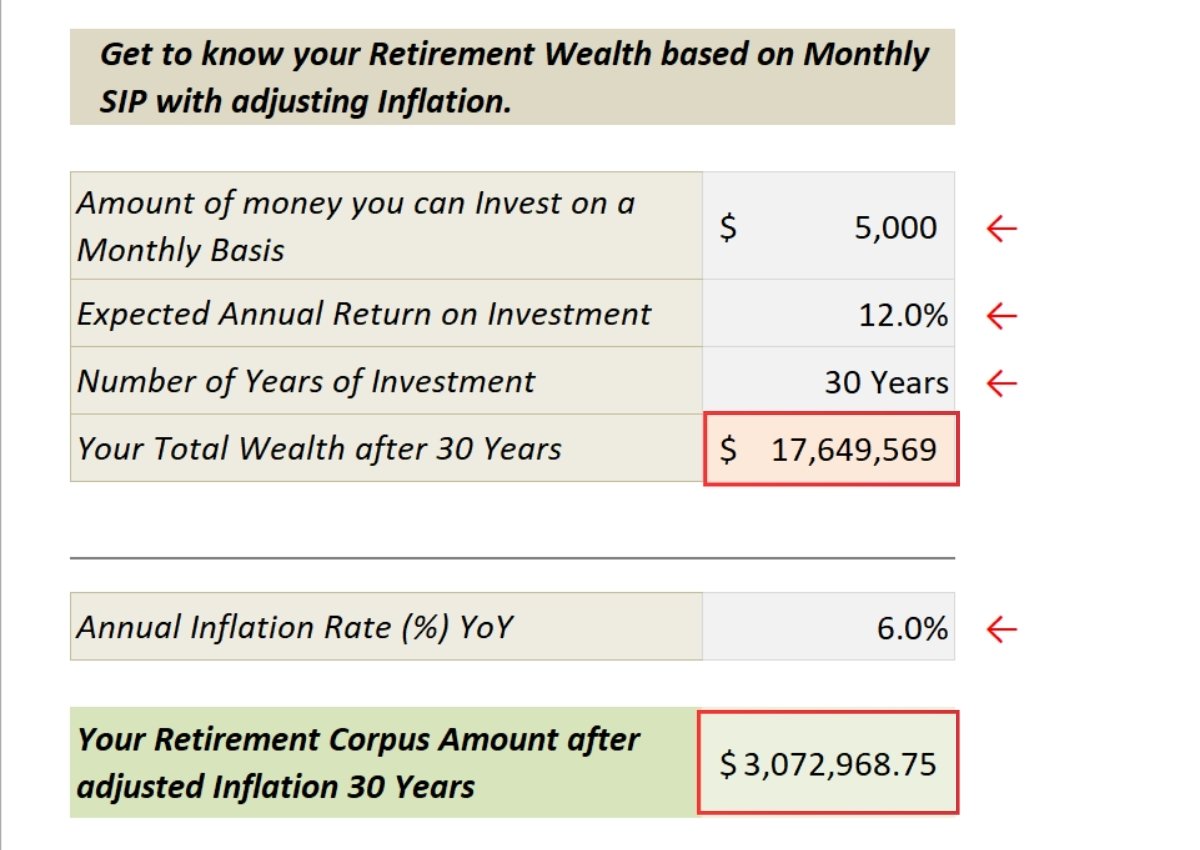

- Decide How Much to Invest Monthly

Start by deciding how much you can comfortably invest. Let’s say you can put ₹5,000 per month into an SIP. You can increase this amount as your income grows, making it a flexible way to save for retirement. - Calculate Your Expected Returns

If your SIP earns an annual return of 12%, investing ₹5,000 every month for the next 30 years can help you build a wealth of approximately ₹1.76 crore. This shows how powerful long-term investments in the best SIP can be. - Adjust for Inflation

We all know that the cost of living rises over time due to inflation. Assuming an annual inflation rate of 6%, your retirement corpus after 30 years, when adjusted for inflation, would be around ₹30.72 lakh. Even though inflation reduces the value, it’s still a significant amount for your future needs. - Start Your SIP for a Secure Retirement

The key to a secure retirement is starting early and investing regularly. Even small SIPs in mutual funds, when compounded over time, can grow into a large sum. By choosing the best SIP and sticking to it, you can achieve your retirement goals.

In conclusion, starting a Systematic Investment Plan (SIP) early can help you build a solid retirement fund. By investing a small amount every month in a mutual fund, you can take advantage of compounding and grow your wealth over time.

Even with inflation, a well-planned SIP can give you enough money to enjoy a comfortable retirement. The key is to start now and invest regularly to reach your financial goals.

Don’t forget to download the Excel template to see how much you need to invest for your retirement. It’s an easy way to plan your future and make sure you’re financially secure!