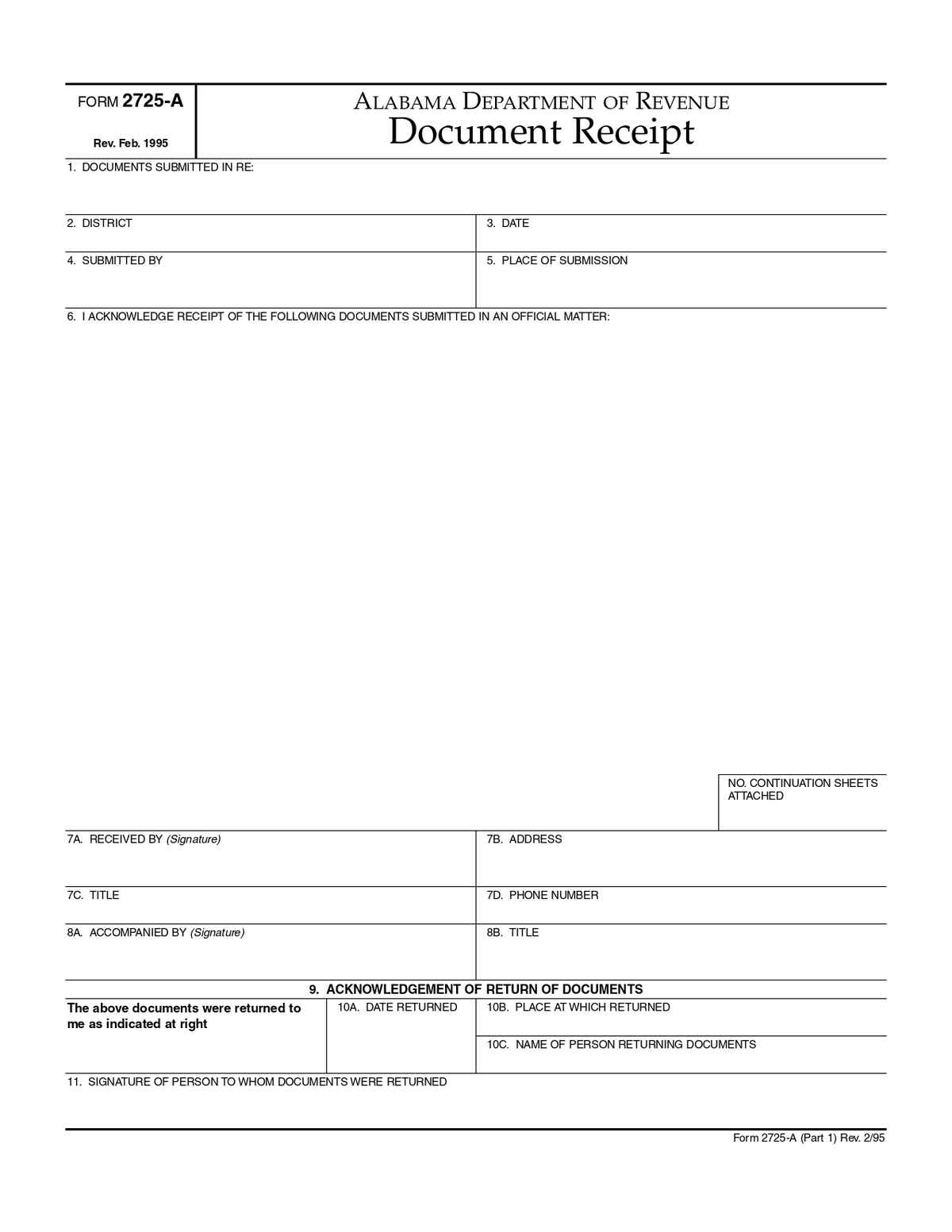

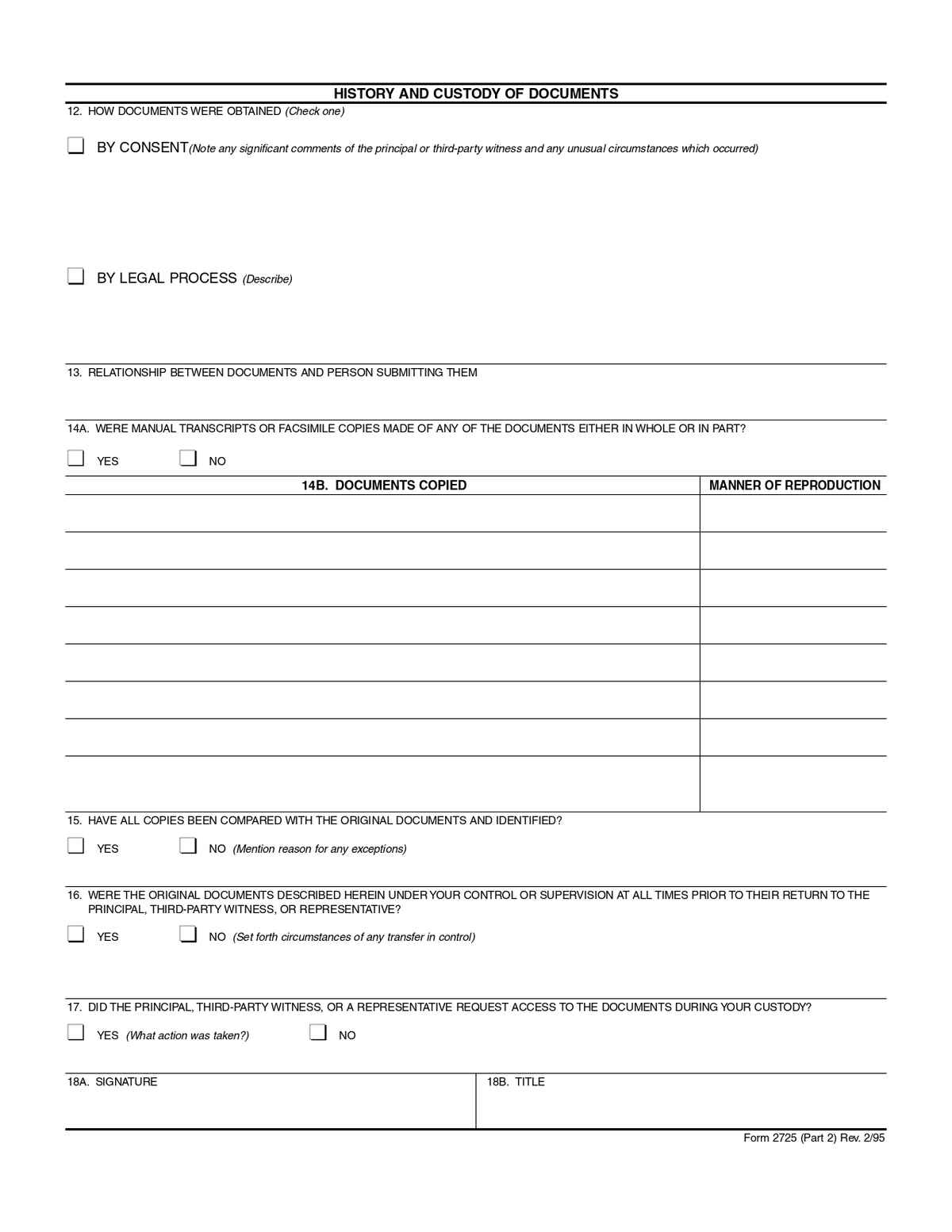

Form 2725-A, issued by the Alabama Department of Revenue, serves as a document receipt to acknowledge the submission and return of official documents. It records details such as the nature of the documents, submission and return dates, and the identities of individuals involved in the transaction.

No. of Pages : 2

The Document Receipt 2725-A Form in Alabama is typically needed by:

- Taxpayers & Businesses – Individuals or businesses submitting official documents to the Alabama Department of Revenue (ADOR) may require this form as proof of submission and return.

- Tax Professionals & Accountants – Those handling tax filings or financial records may use this form to track the movement of important documents.

- Government Agencies & Legal Entities – Agencies or organizations that process official paperwork with ADOR may need this receipt for record-keeping.