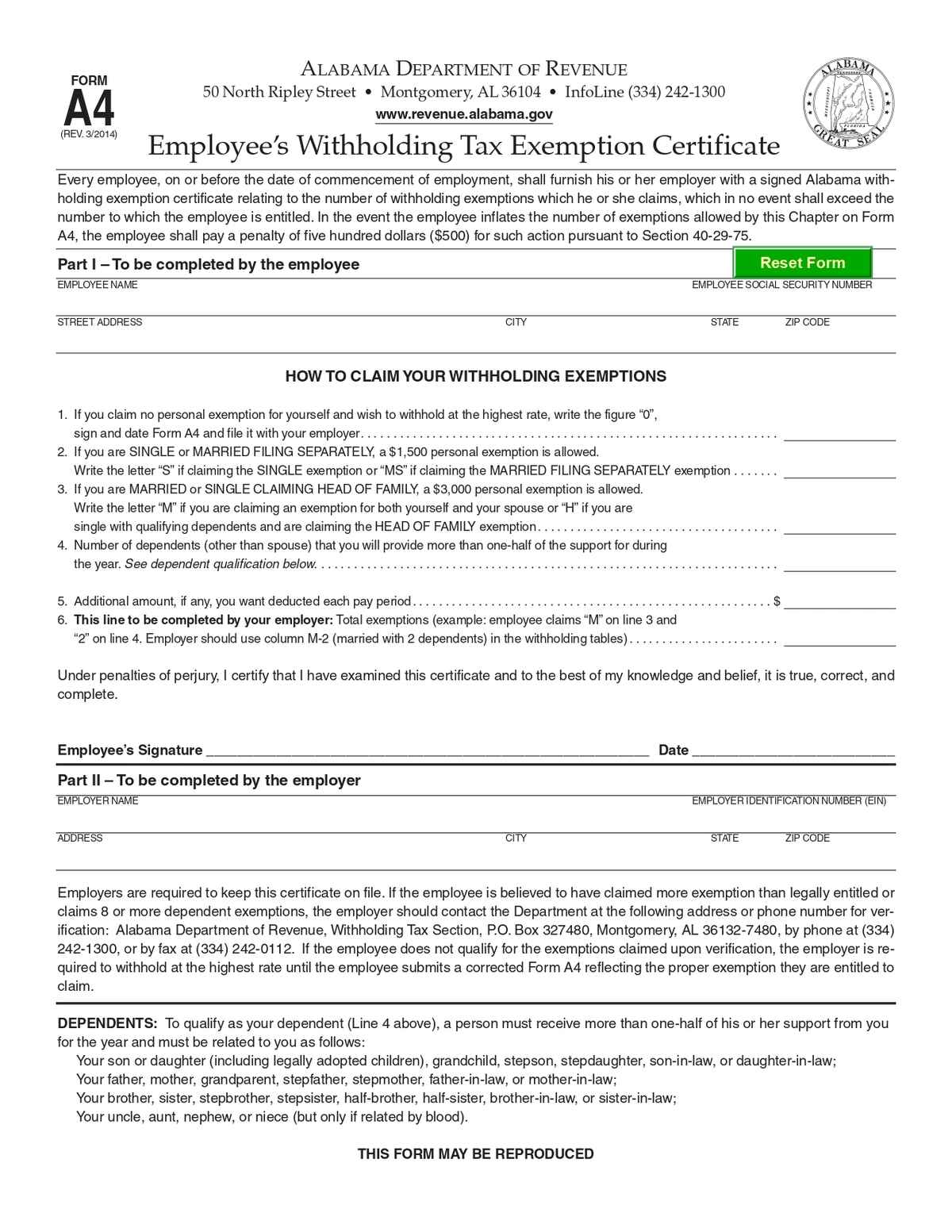

The Employee’s Withholding Exemption Certificate Form (Alabama) is used by employees in Alabama to declare their tax withholding status and exemptions for state income tax purposes. This form helps employers determine the correct amount of state tax to withhold from an employee’s paycheck.

No. of Pages : 1

Who Needs the Alabama Employee’s Withholding Exemption Certificate (A-4) Form?

- Employees in Alabama – To declare their tax withholding status and claim exemptions for state income tax purposes.

- New Hires – Required to complete the A-4 form upon starting a new job to ensure proper tax withholding.

- Employers – To determine the correct amount of Alabama state income tax to withhold from employee wages.

- Payroll Departments – Managing employee tax deductions and maintaining compliance with state tax regulations.

- Tax Professionals – Assisting employees in accurately completing the form based on their tax situation and exemptions.