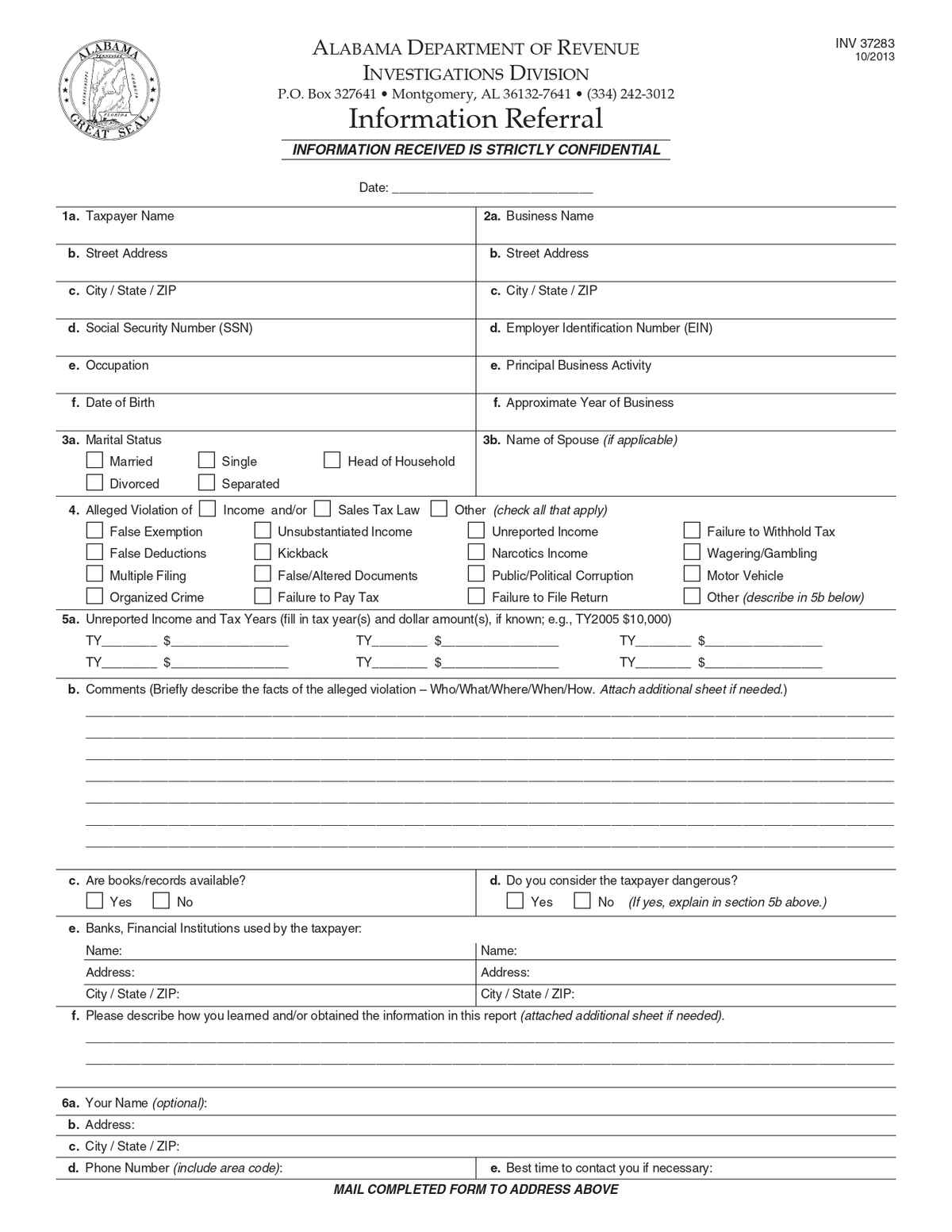

The Information Referral – Report Tax Evasion or Fraud Form (Alabama) allows individuals to report suspected cases of tax fraud, evasion, or other violations to the Alabama Department of Revenue. This form helps authorities investigate and take necessary legal action against fraudulent activities.

No. of Pages : 1

Who Needs the Alabama Information Referral – Report Tax Evasion or Fraud Form?

- Concerned Citizens – Individuals who suspect and want to report tax fraud or evasion in Alabama.

- Business Owners – Who notice competitors engaging in fraudulent tax practices that create unfair advantages.

- Employees or Whistleblowers – Reporting tax-related misconduct within their company or by their employer.

- Tax Professionals – Identifying suspicious tax activities and ensuring compliance with state regulations.

- Law Enforcement or Government Agencies – Investigating potential tax fraud cases and enforcing compliance with Alabama tax laws.