Filing ITR we need lots of account statement like how much do you earn, how much interest do you get, how much TDS is deducted, how much is invested in stock and Mutual funds. But now income tax department (ITD) has launched a feature called Annual Information Statement (AIS) in this feature you can view your financial statement and get any information related to your account easily. Whether you file ITR Or not you should see this statement here you can get lots of information from this feature. It is very helpful feature for those who do not want to keep all these Statement. Filing ITR online you need to follow following step carefully.

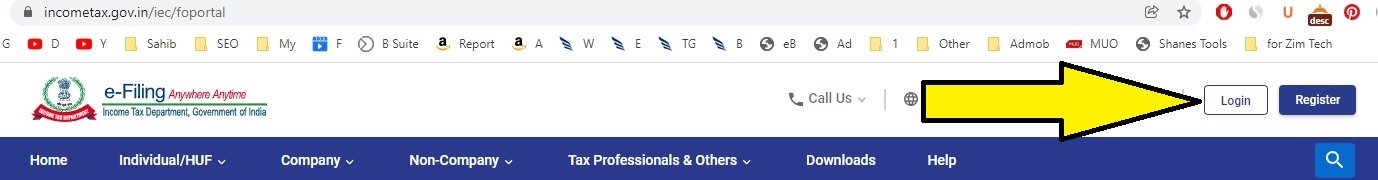

You have to visit Income Tax Official Website incometax.gov.in to see Your annual information statement if you already have an account on this website you need just login but if you are new you need to create your account. How to create new account follow following step it will help you to create your account by your own.

Step 1. Login to Income Tax Website on https://www.incometax.gov.in/

Step 2. Enter User ID and click on Continue then Enter Password and click on Continue.

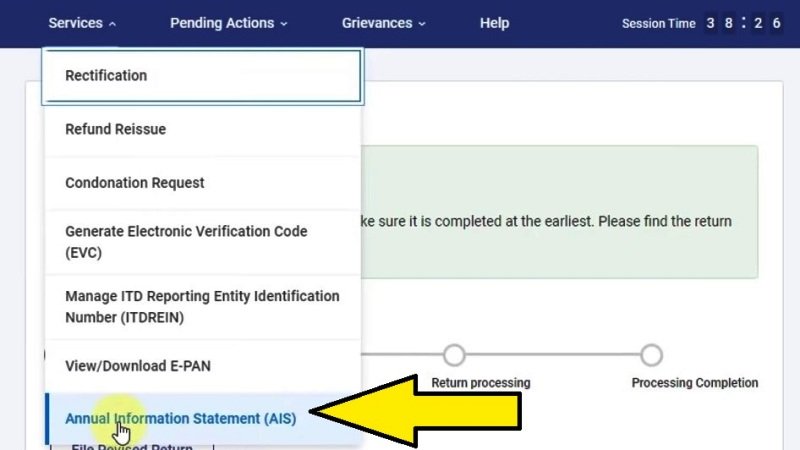

Step 3. Now click on Services Button

Step 4. You will click on AIS to see your Annual Information Statement button, click on it

Step 5. Here you will choose financial year which financial year information do you want to know you have to choose here

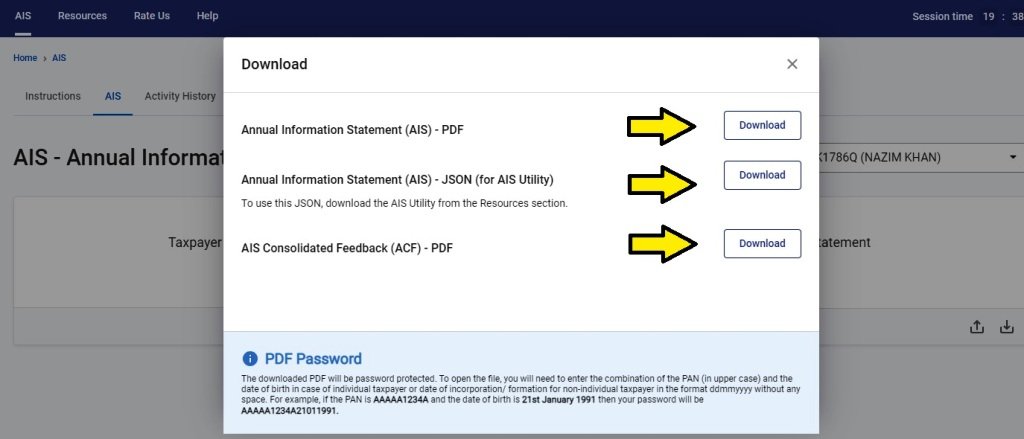

Step 6. Here you will get two options one is summary another one is statement in statement you will get full detail information about your account

Step 7. If you want to see your information summary click on download button after downloading file you need your pass word which is your PAN card no. and date of birth after that it will open and you can see your summary

Step 8. If you want to see your annual information statement click on download button after clicking on download button you need to enter pass word which is your PAN card no. and your date of birth after that it will open and here you can see full information of your account.

Step 9. The downloaded PDF will be password protected. To open the file, you will need to enter the combination of the PAN (in upper case) and the date of birth in case of individual taxpayer or date of incorporation/ formation for non-individual taxpayer in the format ddmmyyyy without any space.

For example, if the PAN is AAAAA1234A and the date of birth is 21st January 1991 then your password will be AAAAA1234A21011991.

Video Guide

Annual Information Statement (AIS) – Income Tax Statement Download | New Portal Pe TDS Kaise Check Kare