What is Family Budget Planner?

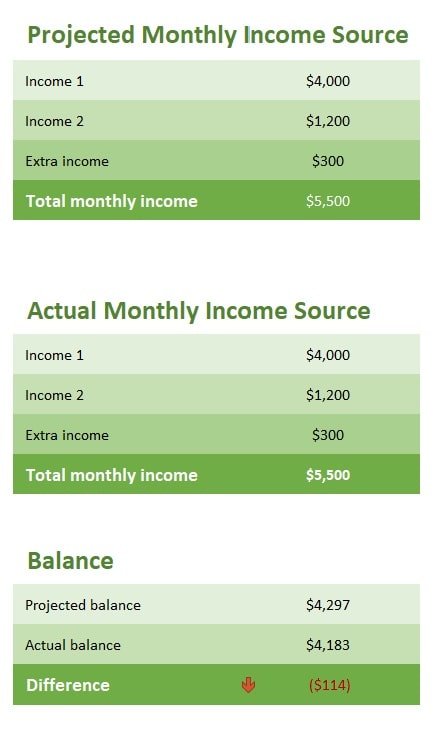

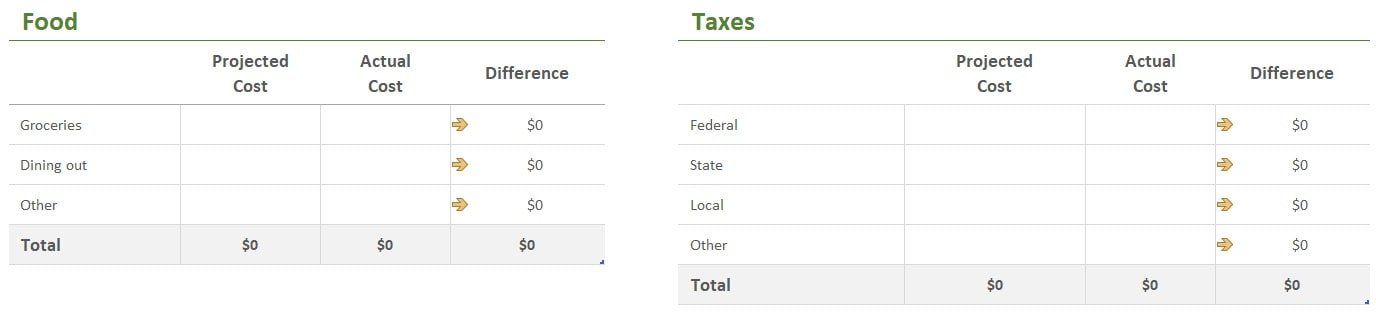

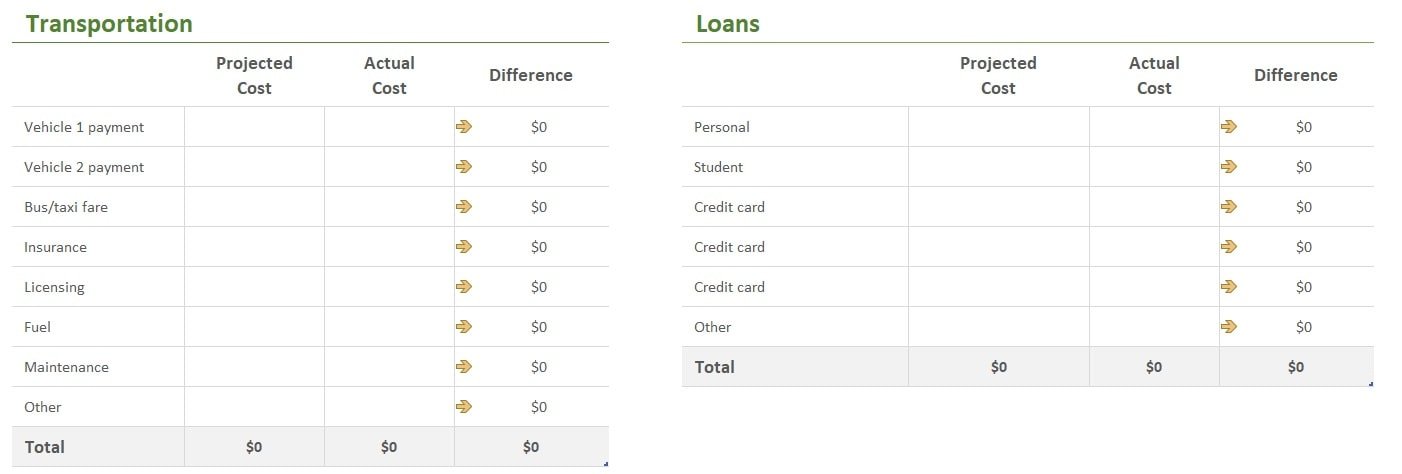

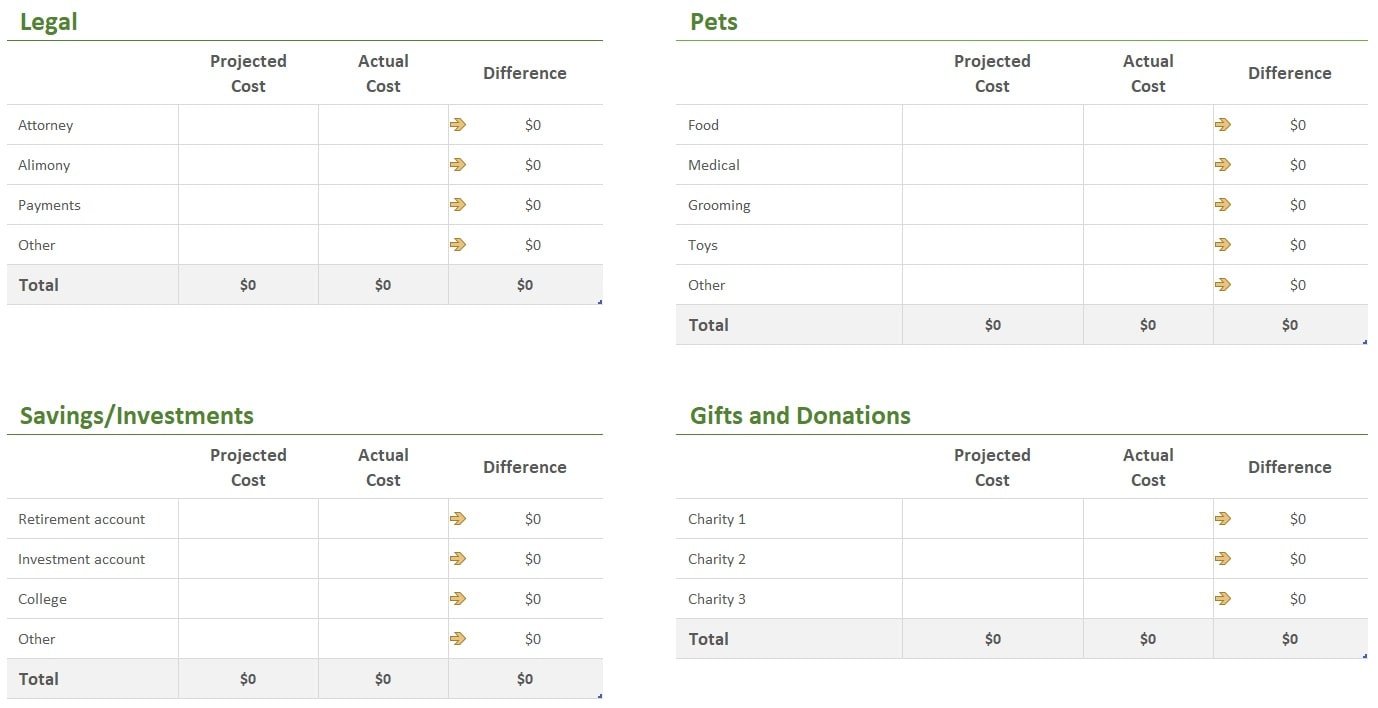

A family budget is a plan for your household’s incoming and outgoing funds for a specific period, such as a month or year. For example, you may allocate specific cash amounts or percentages of your combined monthly income to various costs such as food, as well as savings, investment, and debt repayment.

“Your budget is essentially a tool for empowering yourself,” explains certified financial planner Angela Moore of Orlando.

Many people spend their money without thinking about it, she adds, but you get to pick how to spend it so that it works for you.

So let’s devise a strategy for your strategy.

Begin by making estimations for your household budget.

Moore recommends scheduling a time for you and the other adults in your home to begin working on your budget. (This might be you and your partner, adult children, or parents who live with you.) Scheduling holds you accountable and ensures that everyone is calm and up to the task.

Keep Budgeting and Communicating

What’s more essential than getting the budget “perfect” is checking in with your family regularly. Like your initial audit, schedule regular budget reviews to note how spending has changed (or not) and plan for upcoming expenses. It’s important to communicate about the money itself but how you’re feeling about it, Shyu says. Express if you’re nervous about budgeting or ashamed of debt, she says.

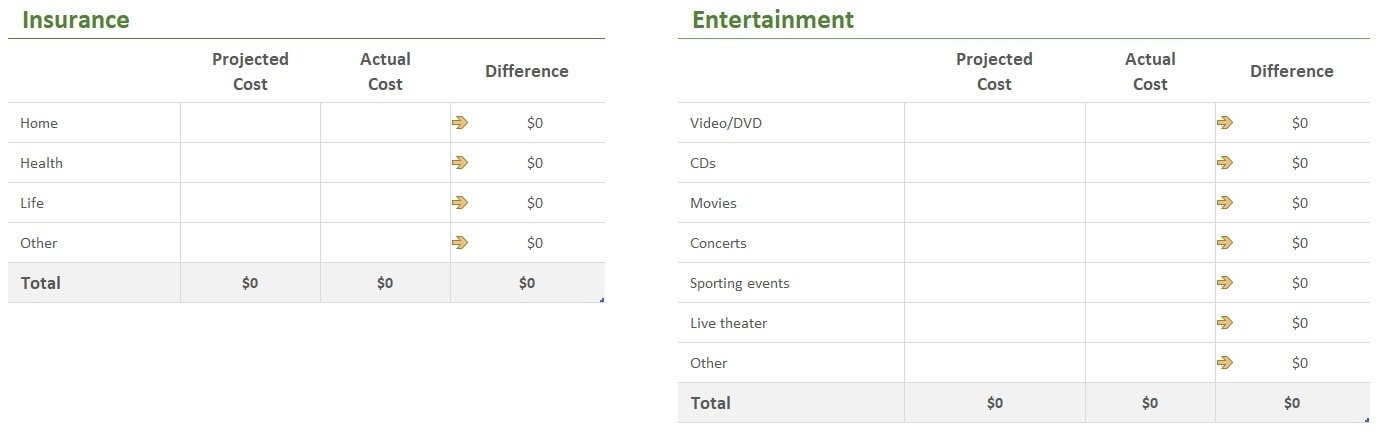

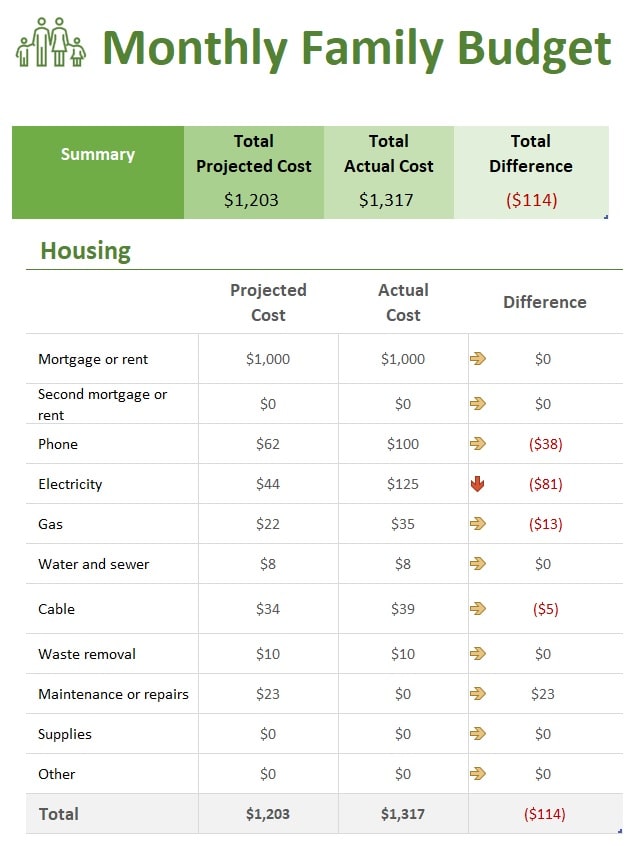

Use the below template for calculating your family budgeting.