Installment or Repayment Schedule Chart – A Smart Financial Tool

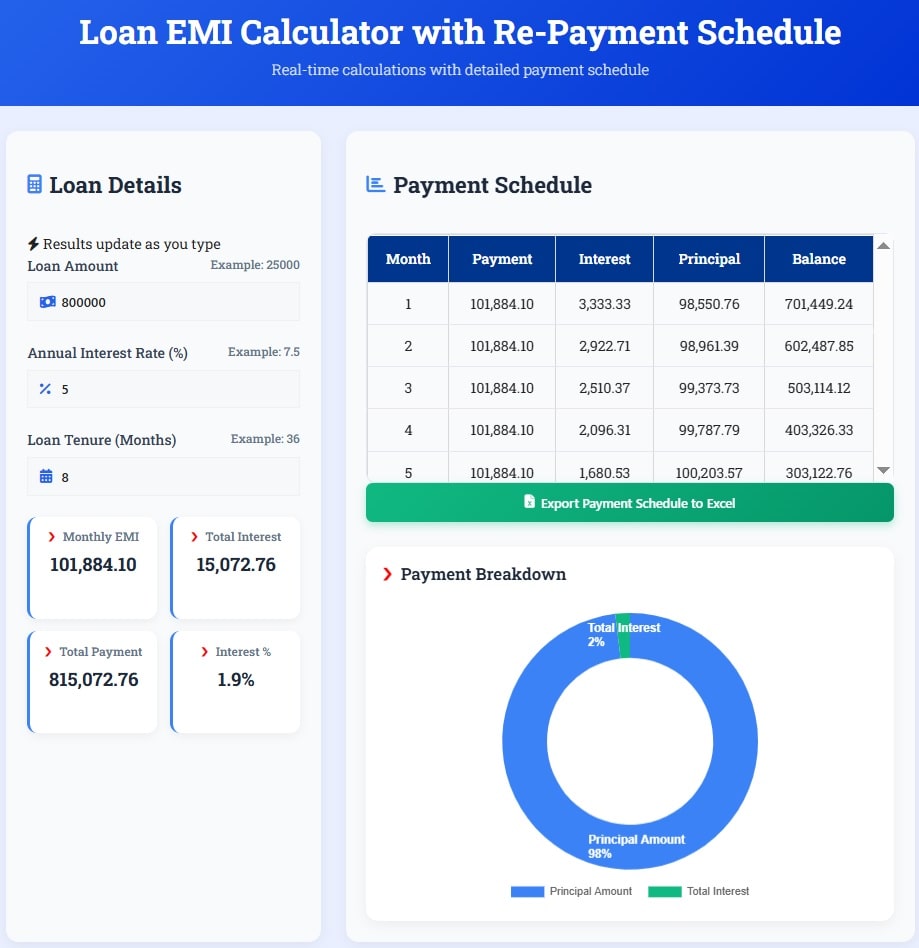

Here below down you can download the EMI calculator in Excel format, which will help you to calculate the EMI of Any Loan Like-Home, Car Loan, Personal Loan, etc. So below is the screenshot for the EMI Calculator in Excel Sheet.

EMI Calculator in Excel (.xlsx File)

Online EMI Calculator

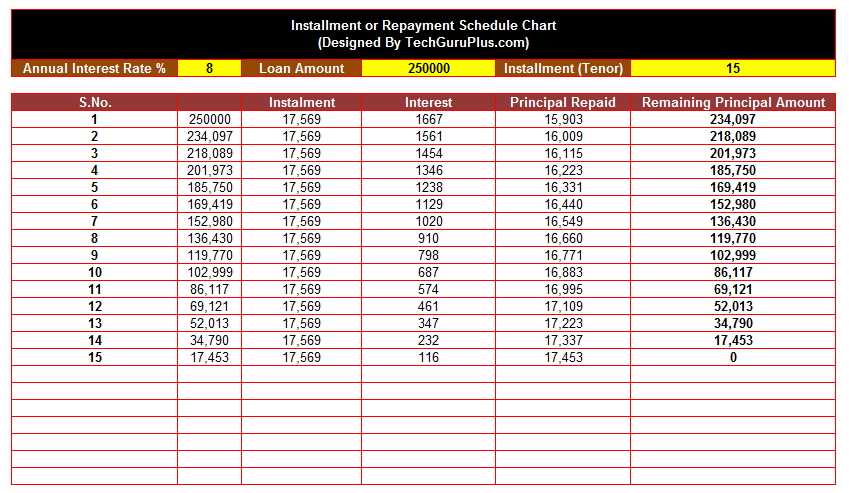

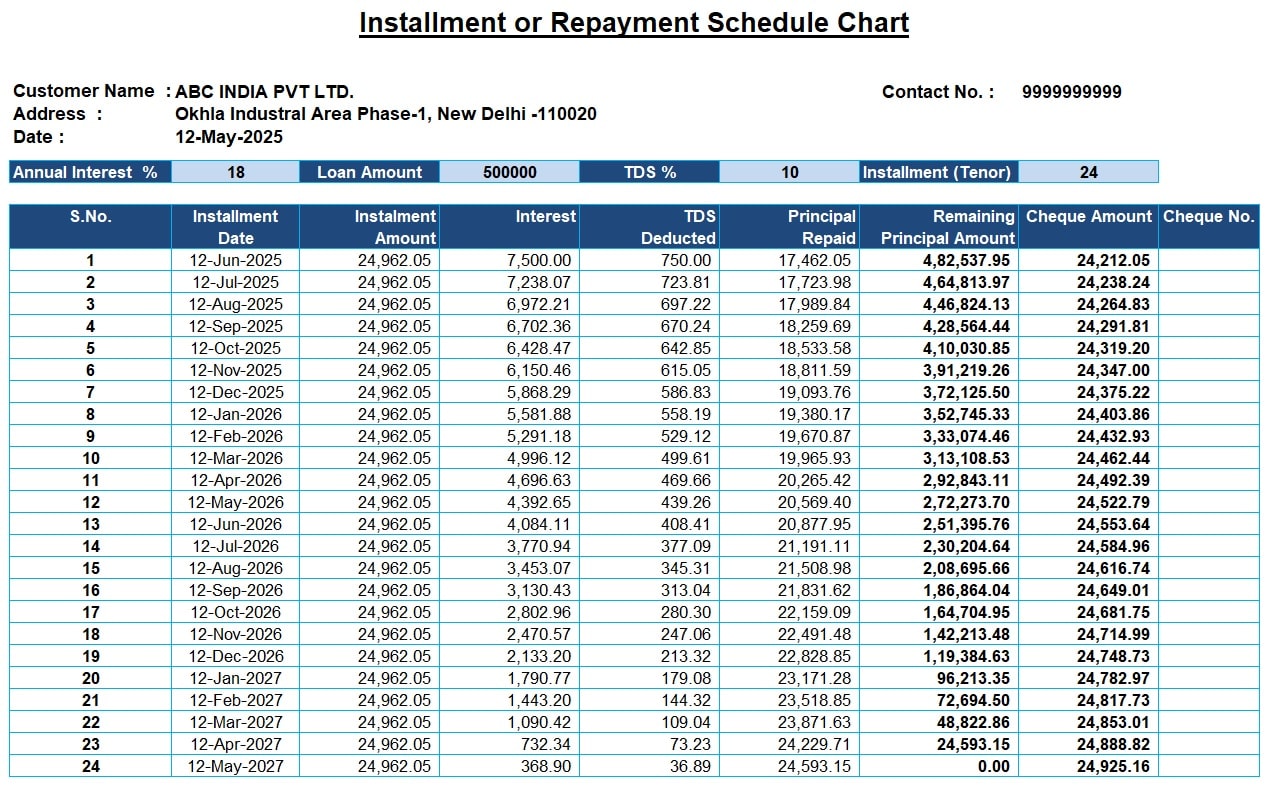

This Excel-based Installment or Repayment Schedule tool is designed to help users generate a detailed and accurate EMI (Equated Monthly Installment) chart for any loan.

By simply entering key loan parameters such as the loan amount, annual interest rate, TDS percentage, installment tenor, and start date, the tool automatically calculates each month’s interest, TDS deducted, principal repaid, and the remaining loan balance. It also provides a cheque-wise breakup for easy tracking of payments.

This tool is ideal for individuals, businesses, and finance professionals who need a clear, month-by-month view of loan repayment progress. With its user-friendly layout and automated calculations, it eliminates the need for manual computation and ensures precision in financial planning.

EMI Calculator with TDS in Excel (.xlsx File)

Managing loan repayments can sometimes be overwhelming, especially when tracking how much of each payment goes toward interest and principal. That’s why we designed this “Installment or Repayment Schedule Chart” in Excel, which offers a clear breakdown of loan installments to help you better manage finances.

Key Features of the Tool:

- Loan Amount and Tenure Flexibility:

- The tool allows input of any loan amount and custom tenure (installment period).

- In the example above, the loan amount is ₹75,00,000 with a tenure of 5 installments.

- Interest Rate Application:

- You can modify the annual interest rate according to your loan agreement.

- In this case, the interest rate is 7% per annum.

- Detailed Breakdown of Each Installment:

- For each installment, the chart shows:

- Interest charged: Varies with the remaining principal.

- Principal repaid: Increases progressively, reducing the remaining balance faster.

- Remaining principal amount: Gives you an idea of how much more you owe after every installment.

- For each installment, the chart shows:

- Amortization with Fixed Installments:

- The installment amount remains constant throughout the tenure, providing consistency in payments.

- In this case, each installment is ₹15,26,352, which helps with budgeting and planning future payments.

- Step-by-Step Calculation:

- The first installment begins with the original loan amount (₹75,00,000).

- With every payment, the interest reduces, and more of the amount contributes toward principal repayment.

- By the final installment, the entire principal is cleared.

How to Use This Chart:

- Input the Loan Amount, Interest Rate, and Tenure: Customize it to your needs.

- Review the Breakdown: Use it to understand how much of each installment goes toward interest and principal repayment.

- Track Your Repayments: Keep an eye on the remaining principal to avoid any surprises.

Benefits of Using the Repayment Schedule Chart:

- Clear Planning: Know in advance how each installment impacts your loan.

- Transparency: Get clarity on interest payments versus principal repayment.

- Budget-Friendly: Plan your cash flow better with fixed installments.

- Flexibility: Easily modify the chart to suit your changing financial needs.

This repayment schedule ensures that you stay on top of your loan payments with ease. It’s a practical tool for anyone dealing with loans – whether personal, business, or housing – helping you stay organized and stress-free.

Start managing your loans smarter with this simple yet powerful tool from TechGuruPlus.com!

Excellent Guru…..

Please add EMI Payment date also

addition of prepayment colum total intreswt paid coloum req

sir muje flat rate me excel chahiye so please send the format urgent

Thank you

GOOD EVENING SIR,

I have taken an education loan, the pnb bank as given the breakup of principle an interest component. however, i have downloaded ur excel sheet to verify the calc. it is not matching. how this has happened.

please check the same

loan amount=3715467, int 10.75%, term 180months

p-16,260.73, int-25,168

your excel is showing different

p-8364, int-33284

request clarify

How we calculate flat interes rate ?

need excel file

I need emi calculator excel

Pls tell how to calculate flat emi with separate interst and penal.

good

nice

I WANT TO CALCULATE LOAN SCHEME IN BULK CASES TO DEFINE EMI AMOUNT AND TENURE.

i want month wise principal amount and interest amount for all months

nothing

GOOD

NA

good job

BEST.

I WANT TO DOWNLOAD EXCEL SHEET FOR EMI CALCULATOR

Extra Payments means (Start at Payment No,Extra Payment,Payment Interval,Extra Annual Payment,Payment,Total Extra Payments) Additional Payment .Variable or Fixed Rate ,Impact of interest rate HIKE on your loan EMI & repayment schedule & Impact of interest rate CUT on your loan EMI & repayment schedule ? how to create in excel & Suppose provide only interest

do you have flat interest rate calculator excel file

SIR ALSO INSERT THE START DATE END DATE & F.Y TO GENERATE REPORT

Sure Abhishek Ji, i will insert

This is good sheet , I appreciate it . If you can add bulk payment somewhere , that will be excellent

Sandeep Ji, i will try to Add.

Thanks

add one column to show month

ok i will try to add.

superb guru! Thanks 👍👍

Welcome Alok Ji

If we can add a column for EMI paid and then based on that if sheet shows the values like how it changes when we pay extra amount or less amount.

ex – if our emi is 10000 and we paid 12000 this month then what is outstanding amount…

Ok Abhishek ji, i will try to add

Hi buddy,

It should be repayment option for year

Emi calculator is good but I want to advance payment with loan calculation.

i need EHI calculator which will be repaid Hal ferly in a year

Thanks for the calculation, but it does not have any prepayment option to check. Also, it does not tally with the SBI way of calculating the interest (as per SBI – ‘SBI charges interest on daily reducing balance’). I do not find any excel to match the interest calculated by SBI. Please make it available if you are aware of it. Thank you

If we are taking loan disbursement in installments, needs input mechanism for the same

monthly emi jaldi chahiye

it would be good if you could include a new column to enter the pre-payment amount so we can see what difference it makes to the emi going forward once the pre-payment amount is intered

If miss the instalment then add it as a penalty charge

add an option of repayment as well.

User friendly .. well

why have we divided interest rate by 1200?

12 written as 12 month and 100 given for percentage calculation, so 12×100 = 1200

Hi,

Canu add the option of repayment, let us say if we pay more than EMI amount and close the loan in 24 months instead of 48 months tenure. so that I can see how much of Interest I have paid in 24 months .

simple to use . great job.

Thanks Guru. Very useful File

Wlcm Alok ji

hello sir

I m tdl developer .

pls.. guid me how to emi Installation value find and Power function(REcap find any value) how to make it TDL Code in Tally prime.

like : 2^5 = 32

i do’nt know how to write function in tdl code pls.. guid us.