What is Personal Monthly Budget?

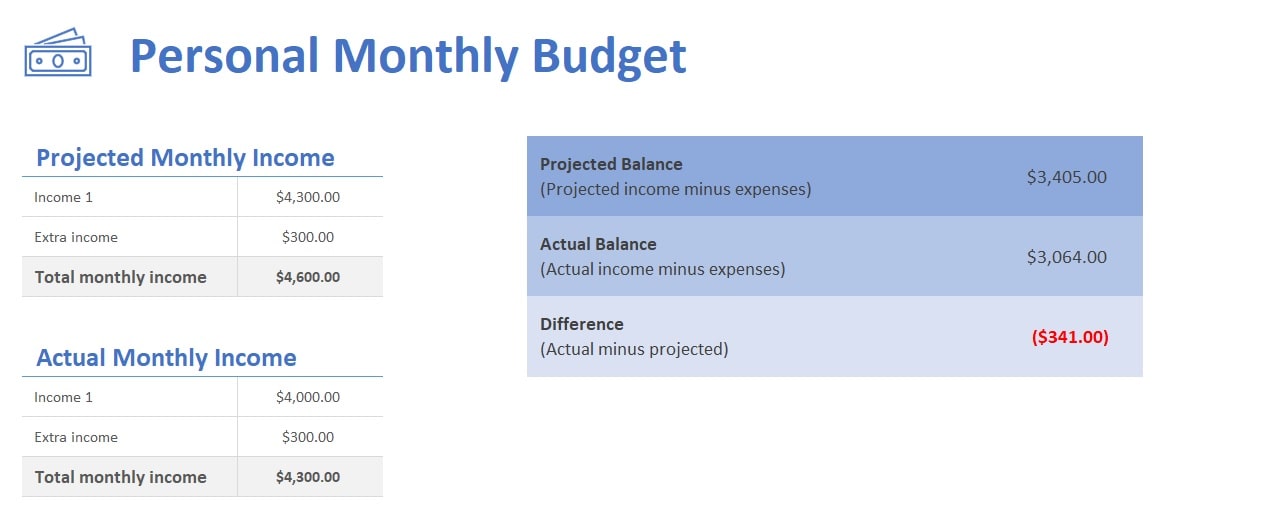

A personal monthly budget template might assist you in planning your spending. It allows you to compare budgeted costs and revenue to actual expenses and income. Above all, a monthly budgeting template gives you a bird’s eye perspective of your present financial status.

A personal budget template, in general, divides your income and spending into areas such as:

- Income – Salary, Bonus, Capital Gain, etc.

- Expenses – Food, transportation, medical, utility, debt, pet, etc.

Budget templates aggregate these different figures together, telling you how much you spend and make in each category.

Why should you use a personal monthly budget template?

Now that you understand a budget template, let’s look at some of the benefits of using one.

Help you track minor details

A budget is only as good as the information included inside it. It’s much easier to keep track of tiny things when you manage your spending and revenue in a professional template. Minor or variable costs may slide through the gaps if a budget template is not used. As a result, you won’t have an accurate picture of your financial situation.

Visualize your Budget

Having all of your income and spending in one location makes day-to-day tracking easier. A budget can help you save money, pay the debt, and achieve other financial goals. If you’re overspending in one area, or under-budgeting in another, you can make adjustments.

Furthermore, most monthly budget templates have the option to graph or chart your data over time, providing you with an easy-to-understand visual depiction of your spending.

The File Contains these Sheets

- Personal Monthly Budget Sheet

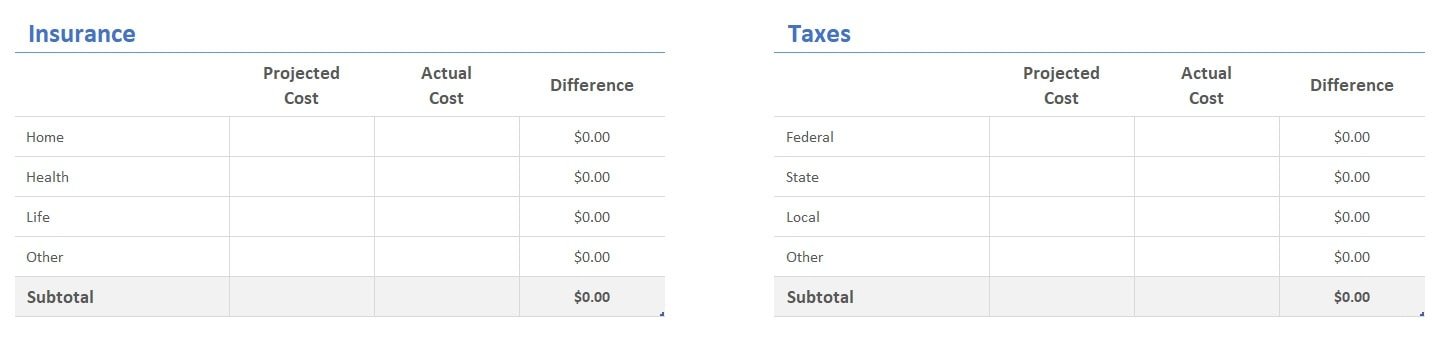

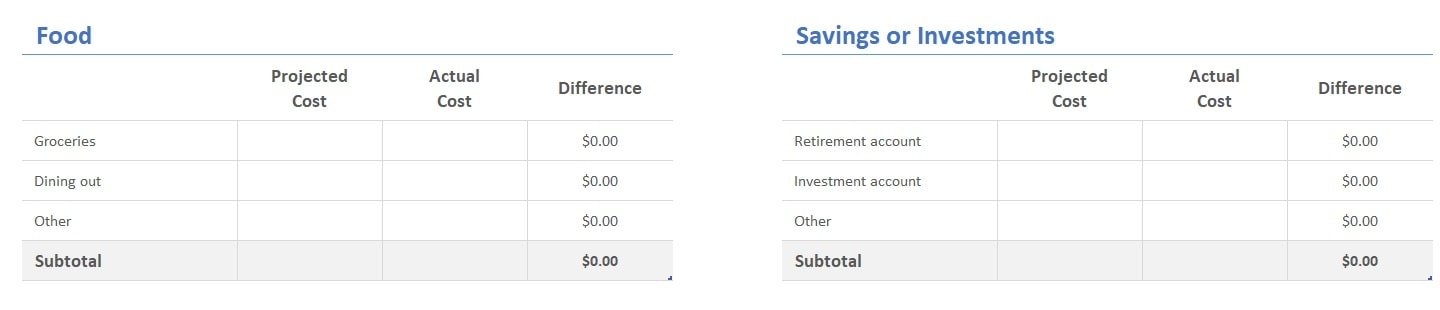

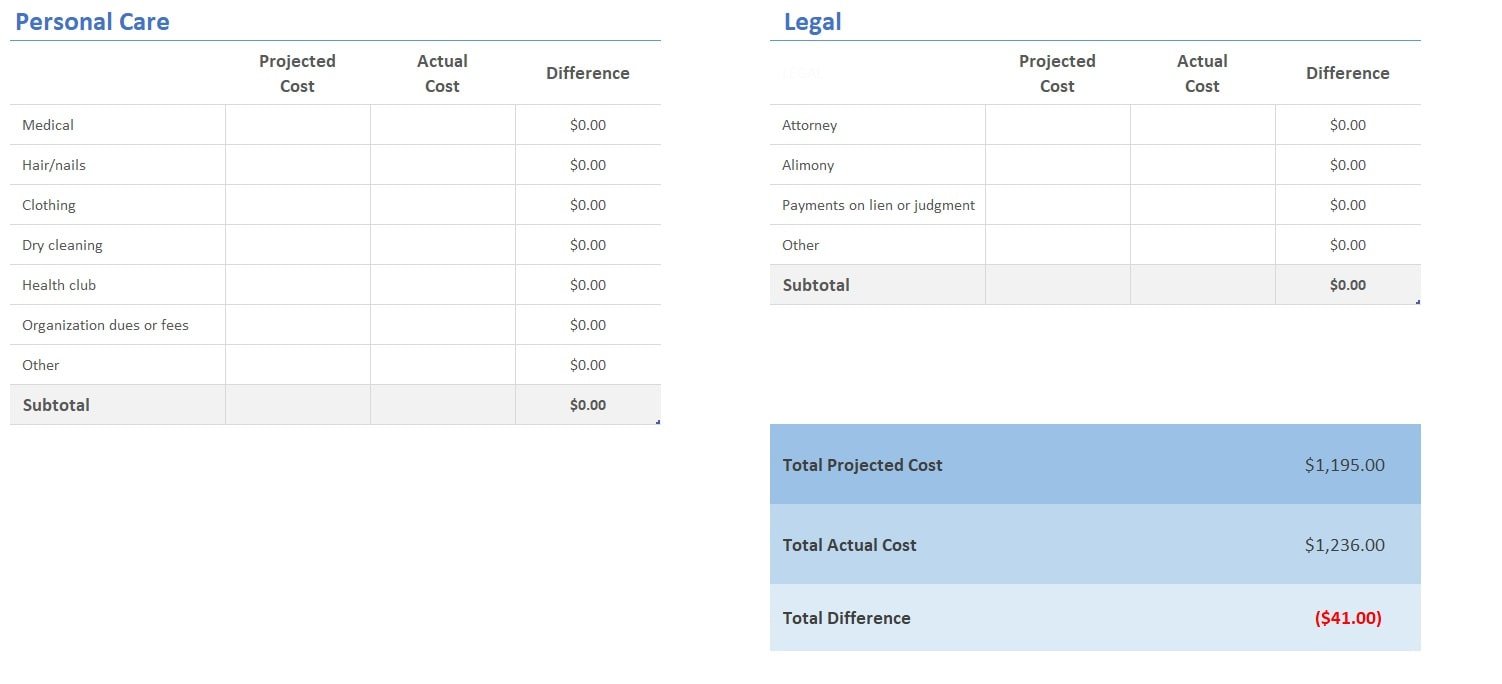

- Housing, Entertainment, Transportation, Loans, Insurance, Taxes, Food, Savings or Investments, Pets, Gifts and Donations, Personal Care, Legal

Personal Monthly Budget Template in Excel