What is Proforma Invoice?

In trade transactions, a proforma invoice is a document that states a commitment from the seller to sell goods to the buyer at specified prices and terms. It is used to declare the value of the trade. It is not a true invoice because it is not used to record accounts receivable for the seller and accounts payable for the buyer.

Simply, a “proforma invoice” is a “confirmed purchase order” where buyer and supplier agree on detail and cost of the product to be shipped to the buyer. A proforma invoice is generally raised when the seller is ready for dispatching the material but he wants to ensure that the payment is being sent before dispatch. And similarly, the customer also wants to know which components are included in the pro forma invoice to avoid disagreements later.

A sales quote is prepared in the form of a proforma invoice which is different from a commercial invoice. It is used to create a sale and is sent in advance of the commercial invoice. The content of a pro forma invoice is almost identical to a commercial invoice and is usually considered a binding agreement, but because a pro forma invoice is not a legally-binding document, the price may change in advance of the final sale.

A proforma invoice can also be used for shipments containing items that are not being bought or sold, such as gifts, samples and personal belongings, whereas a commercial invoice is used when the commodities shipped are being bought or sold. However, it is best to use a customs invoice or declaration as border officials require values for the export declaration. A Customs Invoice or declaration is commonly used in New Zealand for air parcel post shipments.

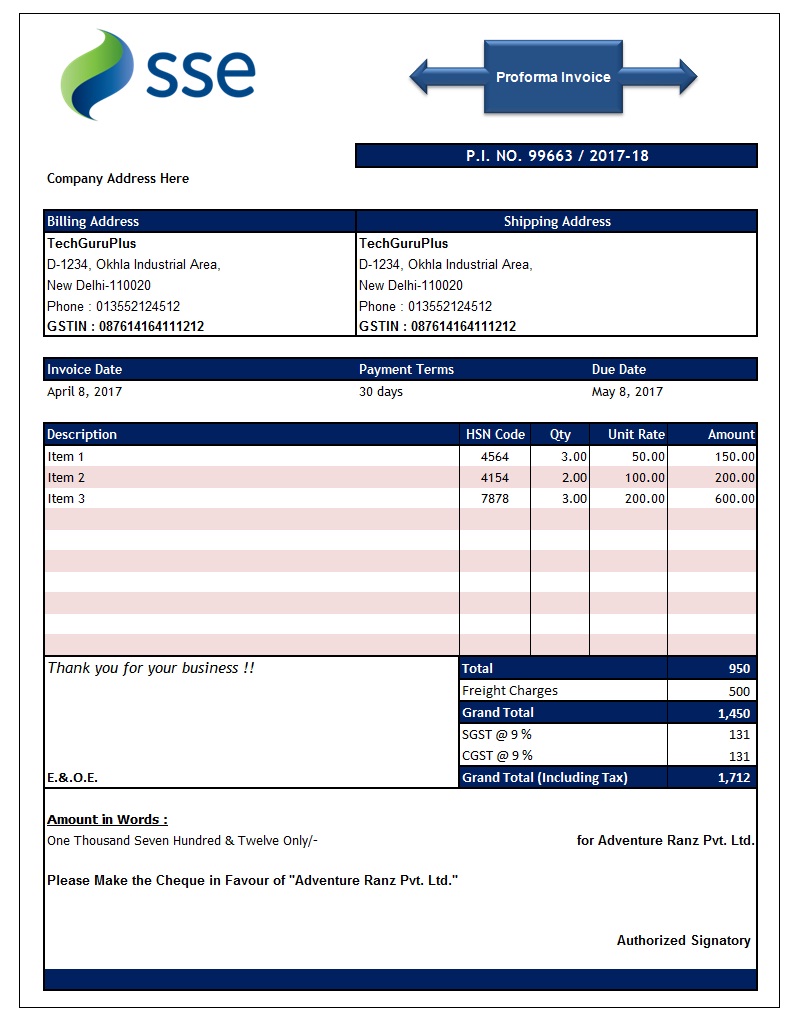

Below is the Preview of this Proforma Invoice

(Excel .xls file download)