Challan ITNS 280 is no longer the primary method for paying income tax in India. It has been replaced by the e-Pay Tax functionality on the income tax department’s e-filing portal.

Here’s a breakdown of the situation:

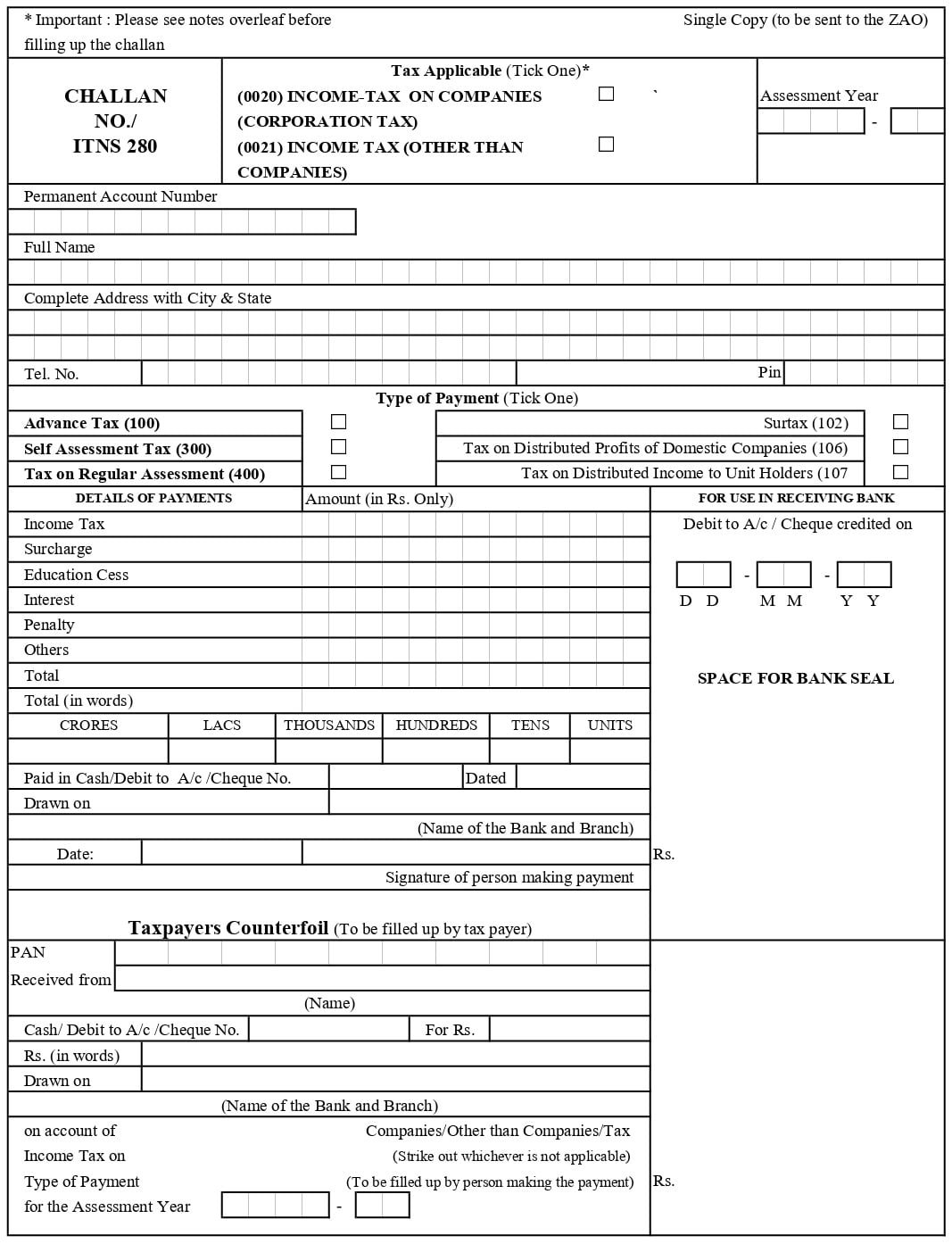

What was Challan ITNS 280?

- Challan ITNS 280 was a form used for making various income tax payments in India.

- It could be used for:

- Advance Tax

- Regular Assessment Tax

- Self-Assessment Tax

- Additional Charges

Why is it not used anymore?

- The income tax department has migrated the payment system to a more convenient online platform called “e-Pay Tax” within the e-filing portal.

- This online system offers a more user-friendly experience and eliminates the need for physical challan forms.

What to do now?

- If you need to pay your income tax in India, you should use the e-Pay Tax functionality on the income tax department’s e-filing portal: https://www.incometax.gov.in/iec/foportal/

- The e-filing portal offers clear instructions and guidance on using e-Pay Tax for various types of tax payments.

Here are some advantages of using e-Pay Tax over Challan ITNS 280:

- Convenience: Make payments online anytime, anywhere.

- Efficiency: Quicker processing and faster reflection of payments.

- Accuracy: Reduced risk of errors associated with manual challan forms.

- Transparency: Track your payment history easily within the e-filing portal.

Overall, the shift to e-Pay Tax simplifies the income tax payment process for taxpayers in India.