1. All about Financial Year

This one-year period in India begins on April 1st and concludes on March 31st. The time during which money is earned is referred to as the Financial Year or Fiscal Year. Income tax returns are submitted, and taxes for a firm are typically paid the following year following the conclusion of the fiscal year. The Assessment Year is the next year in which the income is taxed.

So, if the accounts are being produced for the fiscal year beginning 1 April 2021 and concluding 31 March 2022, the period would be referred to as Financial Year 2021-22. And this income would be taxed the next year, which would be known as Assessment Year 2022-23.

So, if the accounts are being produced for the fiscal year beginning 1 April 2021 and concluding 31 March 2022, the period would be referred to as Financial Year 2021-22. And this income would be taxed the next year, which would be known as Assessment Year 2022-23.

In non scientific words, the financial year is the year in which the income is produced, and the assessment year is the year in which the income is taxed, all taxes are paid, and tax returns are submitted. The income tax regulations and slab rates that will be applied for the assessment year 2022-23 will be the same as those that will be used for the fiscal year 2021-22, and so on.

2. Moving on to the Next Financial Year

Close the books of accounts for a fiscal year swiftly and easily, and transfer your company’s data to the following fiscal year. In Tally Prime, you may accomplish this in a variety of ways. Tally Prime also makes it easier to manage your tax due or input credit when your company data is divided at the start of a new fiscal year.

3. Modify the Current Period

Change the current period to:

- Continue the voucher input in the same firm data to migrate your data to the new fiscal year.

- Transfer all ledger balances without forming a new business.

- Contrast reports from various fiscal years.

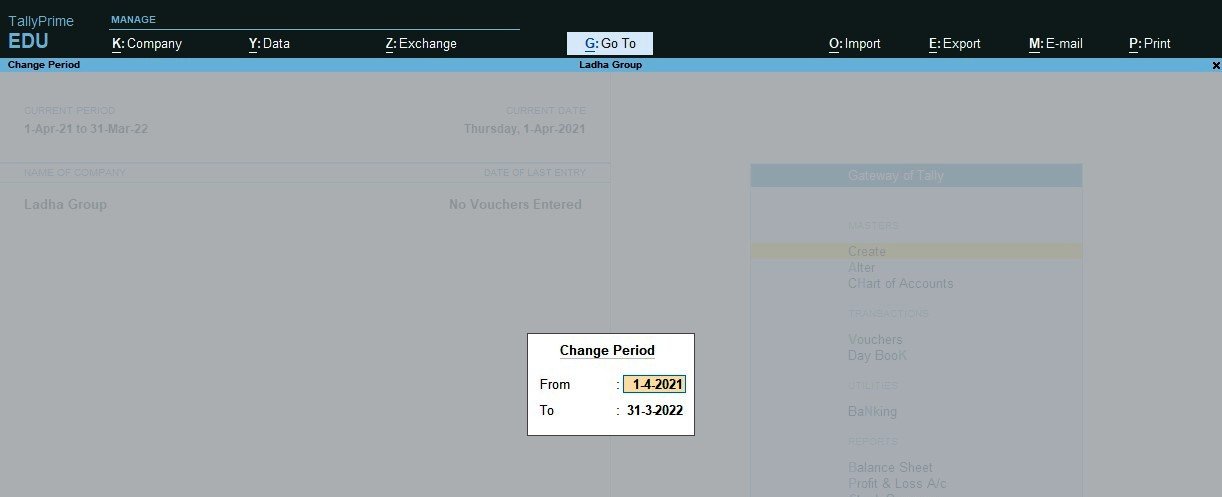

4. To alter the current time period

- Navigate to the Tally Gateway > Press Alt+F2 (F2: Period) and input the dates.

- The Current Period is shown as follows:

When the Current Period is altered, the preceding fiscal year’s balances are carried forward. In the Company Alteration screen, you will keep the financial year beginning from and Books beginning from dates.

To begin recording GST transactions on April 1, 2020, you may resume the voucher numbering process by assigning unique voucher numbers to each of your voucher types. You may learn more about the following topics by visiting the GST FAQ:

Determine your GST liabilities and GST input credit using GSTR-1 and GSTR-3B. Compare your GST Liability and GST Input Credit in your e-ledgers on the GST portal to your books. You may also use the journal voucher to make adjustments against the input tax credit.

Note

In certain nations, the fiscal year begins on January 1st and concludes on December 31st. You can change the current period in such nations by entering 1-Jan with the appropriate year in the from box and 31-Dec in the to field.